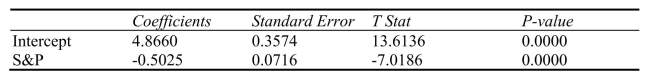

SCENARIO 13-7 An investment specialist claims that if one holds a portfolio that moves in the opposite direction to the market index like the  500, then it is possible to reduce the variability of the portfolio's return.In other words, one can create a portfolio with positive returns but less exposure to risk. A sample of 26 years of S&P 500 i

500, then it is possible to reduce the variability of the portfolio's return.In other words, one can create a portfolio with positive returns but less exposure to risk. A sample of 26 years of S&P 500 i  ndex and a portfolio consisting of stocks of private prisons, which are believed to be negatively related to the S&P 500 inde

ndex and a portfolio consisting of stocks of private prisons, which are believed to be negatively related to the S&P 500 inde  x, is collected.A regression analysis was performed by regressing the returns of the prison stocks portfolio (Y) on the returns of S&P 500 index (

x, is collected.A regression analysis was performed by regressing the returns of the prison stocks portfolio (Y) on the returns of S&P 500 index (  X) to prove that the prison stocks portfolio is negatively related to the S&P 500 index at a 5% level of significance.The results are given in the following EXCEL output.

X) to prove that the prison stocks portfolio is negatively related to the S&P 500 index at a 5% level of significance.The results are given in the following EXCEL output.

-Referring to Scenario 13-7, to test whether the prison stocks portfolio is negatively related to the S&P 500 index, the measured  value of the test statistic is

value of the test statistic is

Definitions:

Methadone

A synthetic opioid used medically both as a pain reliever and in the treatment of opioid addiction.

Endorphins

Naturally occurring chemicals in the body that not only alleviate pain but also enhance sensations of joy.

Opiate

A category of drugs derived from the opium poppy (or synthetic analogs) that primarily act as central nervous system depressants and are used for pain relief.

Amphetamines

Drugs (such as methamphetamine) that stimulate neural activity, causing accelerated body functions and associated energy and mood changes.

Q21: Referring to Scenario 11-4, state the null

Q26: Referring to Scenario 11-4, construct the ANOVA

Q55: Referring to Scenario 15-3, suppose the chemist

Q82: Referring to Scenario 12-11, the decision made

Q107: Referring to Scenario 12-9, at 5% level

Q138: A regression had the following results: SST

Q141: Referring to Scenario 12-11, the critical value

Q153: Referring to Scenario 12-7, the expected cell

Q155: Referring to Scenario 11-10, the within (error)degrees

Q209: Referring to Scenario 11-5, the within-group variation