SCENARIO 13-7 An investment specialist claims that if one holds a portfolio that moves in the opposite direction to the market index like the  500, then it is possible to reduce the variability of the portfolio's return.In other words, one can create a portfolio with positive returns but less exposure to risk. A sample of 26 years of S&P 500 i

500, then it is possible to reduce the variability of the portfolio's return.In other words, one can create a portfolio with positive returns but less exposure to risk. A sample of 26 years of S&P 500 i  ndex and a portfolio consisting of stocks of private prisons, which are believed to be negatively related to the S&P 500 inde

ndex and a portfolio consisting of stocks of private prisons, which are believed to be negatively related to the S&P 500 inde  x, is collected.A regression analysis was performed by regressing the returns of the prison stocks portfolio (Y) on the returns of S&P 500 index (

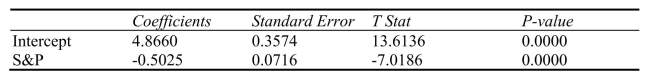

x, is collected.A regression analysis was performed by regressing the returns of the prison stocks portfolio (Y) on the returns of S&P 500 index (  X) to prove that the prison stocks portfolio is negatively related to the S&P 500 index at a 5% level of significance.The results are given in the following EXCEL output.

X) to prove that the prison stocks portfolio is negatively related to the S&P 500 index at a 5% level of significance.The results are given in the following EXCEL output.

-Referring to Scenario 13-7, which of the following will be a correct conclusion?

Definitions:

Federal Budget

A government's plan for revenue and spending over a specific period.

National Debt

The total amount of money that a country's government has borrowed by various means, including foreign governments and domestic lenders.

Treasury Bills

Short-term government securities with maturities of less than one year, sold to investors to finance governmental debt.

Federal Government's Budget

The financial plan for a fiscal year, detailing the government's projected expenses and revenues, managed by the federal government.

Q19: In a two-factor ANOVA analysis, the sum

Q40: Referring to Scenario 11-7, the value of

Q67: When a dummy variable is included in

Q70: Referring to Scenario 13-13, what is the

Q78: Referring to Scenario 15-4, the "best" model

Q89: Referring to Scenario 12-10, what is the

Q91: Referring to Scenario 14-4, which of the

Q139: Referring to Scenario 12-11, the value of

Q181: Referring to Scenario 14-6 and allowing for

Q213: Referring to Scenario 14-10, to test the