SCENARIO 13-7 An investment specialist claims that if one holds a portfolio that moves in the opposite direction to the market index like the  500, then it is possible to reduce the variability of the portfolio's return.In other words, one can create a portfolio with positive returns but less exposure to risk. A sample of 26 years of S&P 500 i

500, then it is possible to reduce the variability of the portfolio's return.In other words, one can create a portfolio with positive returns but less exposure to risk. A sample of 26 years of S&P 500 i  ndex and a portfolio consisting of stocks of private prisons, which are believed to be negatively related to the S&P 500 inde

ndex and a portfolio consisting of stocks of private prisons, which are believed to be negatively related to the S&P 500 inde  x, is collected.A regression analysis was performed by regressing the returns of the prison stocks portfolio (Y) on the returns of S&P 500 index (

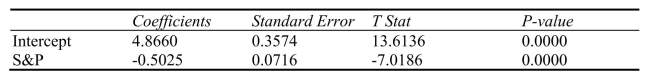

x, is collected.A regression analysis was performed by regressing the returns of the prison stocks portfolio (Y) on the returns of S&P 500 index (  X) to prove that the prison stocks portfolio is negatively related to the S&P 500 index at a 5% level of significance.The results are given in the following EXCEL output.

X) to prove that the prison stocks portfolio is negatively related to the S&P 500 index at a 5% level of significance.The results are given in the following EXCEL output.

-Referring to Scenario 13-7, to test whether the prison stocks portfolio is negatively related to the S&P 500 index, the appropr  iate null and alternative hypotheses are, respectively,

iate null and alternative hypotheses are, respectively,

Definitions:

Bank Reconciliation

The practice of ensuring that the figures in an organization's financial records for a cash account are in agreement with the relevant details on a bank statement.

Balance Per Bank

The amount of money in a company's bank account according to the bank's records at a specific point in time.

Bank Reconciliation

The procedure of reconciling the balance figures in a firm's accounting ledger for a cash account with the associated entries on a bank statement.

Segregation Of Duties

An internal control measure that divides responsibilities among different people to prevent fraud and errors.

Q16: In a simple linear regression problem, r

Q44: Referring to Scenario 15-4, which of the

Q48: Referring to Scenario 15-3, suppose the chemist

Q74: Referring to Scenario 11-2, what should be

Q82: A regression diagnostic tool used to study

Q116: Referring to Scenario 14-15, there is sufficient

Q124: Referring to Scenario 14-16, which of the

Q147: Referring to Scenario 13-1, interpret the p-value

Q198: Referring to Scenario 11-6, the decision made

Q242: Referring to Scenario 14-6, the partial F