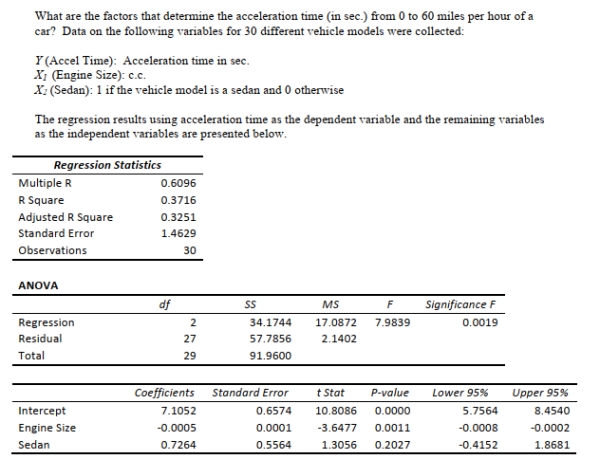

SCENARIO 14-16

14-64 Introduction to Multiple Regression

Introduction to Multiple Regression 14-65

-True or False: Referring to Scenario 14-16, the 0 to 60 miles per hour acceleration time of a

sedan is predicted to be 0.0005 seconds higher than that of a non-sedan with the same engine size.

Definitions:

Debt Securities

Financial instruments representing a loan made by an investor to a borrower, typically including terms for interest payments and the return of principal.

Liquidity Risk

The risk arising from the difficulty of selling an asset without causing a significant movement in its price and losing value.

Stock Exchange

A marketplace where securities, including stocks and bonds, are bought and sold by traders.

Dark Pools

Private financial forums or exchanges for trading securities, not accessible by the investing public, often utilized by large institutional investors to facilitate block trades without impacting the market with their large orders.

Q8: Referring to Scenario 15-6, the variable x₂

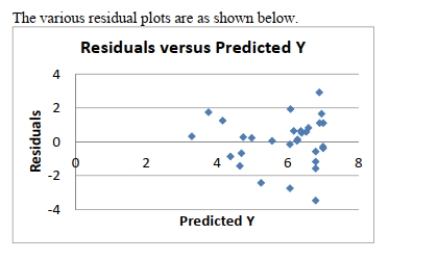

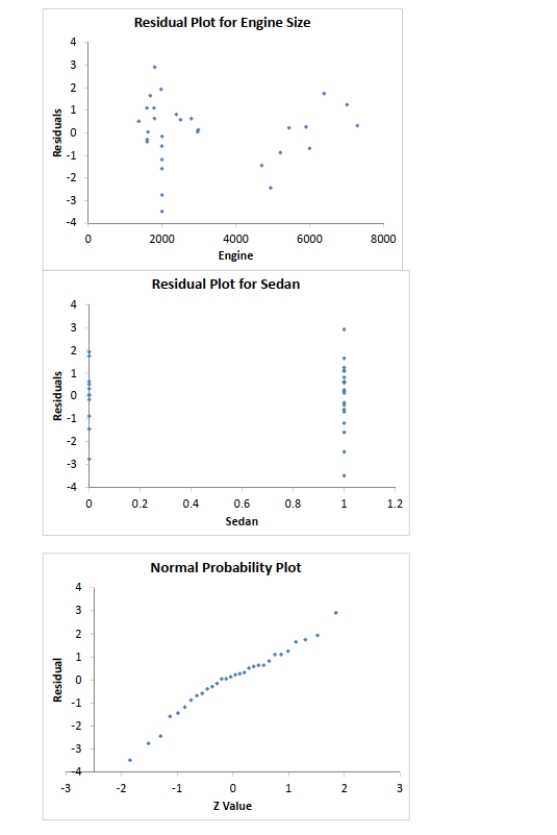

Q38: Referring to Scenario 14-16, the error appears

Q47: Referring to Scenario 14-19, what is the

Q74: Referring to Scenario 14-8, the analyst wants

Q79: Each observation is treated as its own

Q149: Referring to Scenario 16-13, what is the

Q151: Referring to Scenario 16-5, the number of

Q304: Referring to Scenario 14-19, the null hypothesis

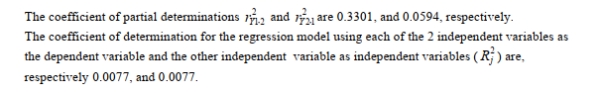

Q331: Referring to Scenario 14-16, what is the

Q336: Referring to Scenario 14-3, one economy in