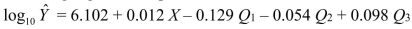

SCENARIO 16-12 A local store developed a multiplicative time-series model to forecast its revenues in future quarters, using quarterly data on its revenues during the 5-year period from 2009 to 2013.The following is the resulting regression equation:  where

where  is the estimated number of contracts in a quarter. X is the coded quarterly value with X = 0 in the first quarter of 2008.

is the estimated number of contracts in a quarter. X is the coded quarterly value with X = 0 in the first quarter of 2008.  is a dummy variable equal to 1 in the first quarter of a year and 0 otherwise.

is a dummy variable equal to 1 in the first quarter of a year and 0 otherwise.  is a dummy variable equal to 1 in the second quarter of a year and 0 otherwise.

is a dummy variable equal to 1 in the second quarter of a year and 0 otherwise.  is a dummy variable equal to 1 in the third quarter of a year and 0 otherwise.

is a dummy variable equal to 1 in the third quarter of a year and 0 otherwise.

-Referring to Scenario 16-12, in testing the significance of the coefficient of X in the regression equation (0.012) which has a p-value of 0.0000.Which of the following is the best interpretation of this result?

Definitions:

Par Value

Par Value is the face value of a bond or the stock value stated in the corporate charter, below which shares cannot be issued.

Transaction Fee

A fee charged for conducting a financial operation such as trading securities, processing payments, or other transactions.

Shares

Units of ownership interest in a corporation or financial asset, giving holders a portion of the company's profits and decision-making power.

PE Ratio

A valuation metric for stocks, calculated by dividing the current market price of a stock by its earnings per share.

Q11: Referring to Scenario 15-6, what is the

Q12: A debate team of 4 members for

Q28: Referring to Scenario 14-8, the value of

Q31: Referring to Scenario 15-6, the variable X3

Q37: Referring to Scenario 16-9 and using a

Q112: Which of the following is NOT among

Q129: Referring to Scenario 16-4, exponential smoothing with

Q149: Referring to Scenario 14-11, the overall model

Q197: Referring to Scenario 18-10 Model 1, which

Q233: Referring to Scenario 18-9, _ of the