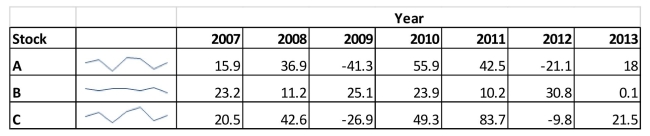

SCENARIO 17-1 The table below contains the sparklines for the rates of return (in percentage)for three different stocks from 2007 to 2013.

-Referring to Scenario 17-1, the sparklines enable you to conclude that the rates of return of the stock market in general are volatile from 2007 to 2013.

Definitions:

Asset Classes

Categories of assets, such as stocks, bonds, real estate, and commodities, that exhibit similar characteristics and behave similarly in the marketplace.

Agency Problems

Conflicts of interest that arise when there's a disconnect in objectives between decision-makers (agents) and the owners (principals) of an entity.

Corporate Spies

Individuals or entities that engage in espionage or intelligence gathering on competitors for commercial purposes, not for national security.

Security Analysts

Professionals who perform analysis on securities or the security market to make investment recommendations.

Q5: Referring to Scenario 15-6, the model that

Q12: Referring to Scenario 15-6, there is reason

Q17: Referring to Scenario 16-13, what is the

Q29: In the United States, the control limits

Q55: Referring to Scenario 15-3, suppose the chemist

Q72: Some consider bullet graphs little more than

Q152: Referring to Scenario 18-8, there is sufficient

Q160: Referring to Scenario 16-5, the number of

Q181: The weight of a randomly selected cookie

Q300: A sample of 200 students at a