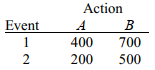

SCENARIO 20-2

The following payoff matrix is given in dollars.

Suppose the probability of Event 1 is 0.5 and Event 2 is 0.5.

-Referring to Scenario 20-2,the EVPI is

Definitions:

Net Present Value

A method used in capital budgeting to assess the profitability of an investment or project by calculating the difference between the present value of cash inflows and outflows.

Average Rate of Return

A monetary measurement for assessing an investment's profit efficiency, determined by dividing the yearly average profit by the cost of initial investment.

Cash Payback

A capital budgeting method that estimates the time required for an investment to generate cash flows sufficient to recover its initial cost.

Internal Rate of Return

A financial metric used in capital budgeting to estimate the profitability of potential investments, calculated as the discount rate that makes the net present value of all cash flows from a particular project equal to zero.

Q1: Referring to Scenario 20-1, if the probability

Q31: Once the control limits are set for

Q91: Referring to Scenario 19-7, based on the

Q102: Referring to Scenario 19-7, an R chart

Q119: Referring to Scenario 19-3, suppose the analyst

Q135: Referring to Scenario 18-10 and using both

Q147: Referring to Scenario 18-10 Model 1, _

Q184: Referring to Scenario 18-9, the errors (residuals)appear

Q231: Four surgical procedures currently are used to

Q261: Referring to Scenario 18-9, _ of the