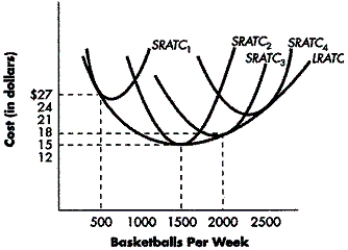

This figure shows the long-run average total cost curve for a firm that produces basketballs, along with four short-run average total cost curves. Each of the short-run average total cost curves corresponds to a different plant size. SRATC₁ corresponds to Plant size 1, SRATC₂ corresponds to Plant size 2, and so forth.

FIGURE 7-5

-Refer to Figure 7-5. What is the total cost of producing 500 basketballs per week, assuming the firm uses the optimal plant size for producing that quantity of output?

Definitions:

Interest Rate Risk

The risk of losses due to fluctuations in interest rates that can affect investment values and borrowing costs.

Time To Maturity

The duration until a financial instrument, such as a bond or loan, reaches its due date and the principal must be repaid.

Increases

Describes an upward trend in numerical value or volume.

Bond Ratings

Assessments of the creditworthiness of corporate or governmental bonds, reflecting the issuer's ability to make bond payments, issued by rating agencies.

Q9: The graph above represents a price-taking firm

Q14: In what way is monopolistic competition like

Q29: If the government wants to increase the

Q52: What is the term for the benefit

Q58: When the marginal cost curve lies below

Q82: Why might an economist argue that Canadian

Q87: When a monopolist is producing at the

Q89: The demand for a product is unit

Q106: Refer to Figure 7-3. Which is the

Q111: Which of the following is NOT likely