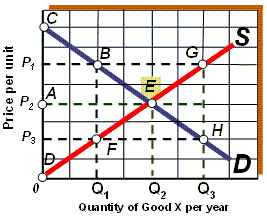

Exhibit 3A-2 Comparison of Market Efficiency and Deadweight Loss  As shown in Exhibit 3A-2, if the quantity supplied of good X per year is Q1, the result is:

As shown in Exhibit 3A-2, if the quantity supplied of good X per year is Q1, the result is:

Definitions:

General Sales Tax

A tax imposed on sales transactions, applied to the sale of most goods and some services, and usually calculated as a percentage of the sales price.

Marginal Tax Rate

Refers to the rate at which the last dollar of income is taxed, indicating the impact of an additional dollar of income on tax liability.

Marginal Tax Rate

is the rate at which the next dollar of income will be taxed, reflecting the percentage of additional income that is paid in tax.

Local Governments

The administrative bodies that govern smaller regions within a country, often responsible for local policies and services.

Q10: The finite nature of the economy's resource

Q19: Exhibit 4-3 Supply and demand curves <img

Q32: If a shortage of a product currently

Q39: Exhibit 2-10 Production possibilities curve data<br><img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX9027/.jpg"

Q141: Exhibit 4-4 Supply and demand curves for

Q141: Exhibit 2-13 Production possibilities curve <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX9027/.jpg"

Q152: If individuals who sit in the back

Q160: Exhibit 2-9 Production possibilities curve <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX9027/.jpg"

Q199: Which of the following will increase the

Q238: Exhibit 4-4 Supply and demand curves for