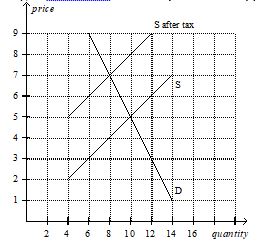

Using the graph shown,answer the following questions.

a.What was the equilibrium price in this market before the tax?

b.What is the amount of the tax?

c.How much of the tax will the buyers pay?

d.How much of the tax will the sellers pay?

How much will the buyer pay for the product after the tax is imposed?

How much will the seller receive after the tax is imposed?

As a result of the tax,what has happened to the level of market activity?

Definitions:

Favorability

The degree to which something is perceived positively or benefits someone.

Dispute

A disagreement, argument, or debate, particularly one that is prolonged or legal in nature.

Neighbor

An individual who lives near or next to another; in broader terms, a person who is part of one's immediate geographical community.

Temporal Discounting

The inclination to prioritize short-term gratification over long-term benefits.

Q16: You receive a paycheck from your employer,and

Q20: Justin builds fences for a living.Justin's out-of-pocket

Q53: Price floors are typically imposed to benefit

Q83: Using the graph shown,in which the vertical

Q115: The minimum wage was instituted to ensure

Q163: Total surplus<br>A) can be used to measure

Q192: Refer to Figure 7-20.At equilibrium,total surplus is<br>A)

Q216: Refer to Figure 7-7.If producer surplus is

Q299: Refer to Figure 7-17.Which area represents total

Q354: Refer to Figure 6-22.The effective price that