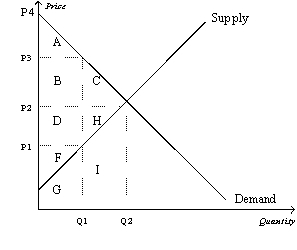

Figure 7-19

-Refer to Figure 7-19.If the price were P3,consumer surplus would be represented by the area

Definitions:

Excise Taxes

Taxes paid when purchases are made on a specific good, such as gasoline, usually levied by the government on the sale of goods and services.

Shifting of Taxes

The process by which the burden of a tax is transferred from one party, such as the seller, to another, such as the buyer.

Perfectly Inelastic

A situation where the demand for a product does not change in response to a change in price.

Excise Tax

A tax levied on specific goods, services, or transactions, often based on quantity purchased rather than value, such as taxes on cigarettes, alcohol, and fuel.

Q69: The Surgeon General announces that eating chocolate

Q113: Which of the following is not correct?<br>A)

Q155: Refer to Figure 8-6.Without a tax,the equilibrium

Q178: When a tax is placed on the

Q265: Refer to Table 7-11.Both the demand curve

Q294: Refer to Figure 7-4.If the price of

Q323: Ray buys a new tractor for $118,000.He

Q397: Coffee and tea are substitutes.Bad weather that

Q402: If a price ceiling of $1.50 per

Q484: Regardless of whether a tax is levied