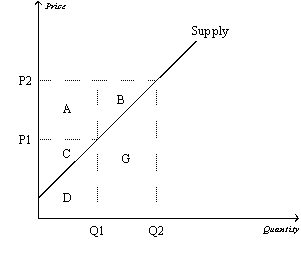

Figure 7-12

-Refer to Figure 7-12.When the price falls from P2 to P1,which of the following would not be true?

Definitions:

Beta

A measure of a stock's volatility in relation to the overall market; a beta above 1 indicates that the stock is more volatile than the market, while a beta below 1 indicates it is less volatile.

Unadjusted Beta

Unadjusted beta is the raw beta value of a security or portfolio without any adjustments for its specific risks and characteristics, typically used as a measure of its volatility against the market.

Adjusted Betas

Betas that have been modified to account for the tendency of a stock's market risk measure to regress towards the mean over time, used in finance to predict future betas.

Market Index

A statistical aggregate that measures the performance of a basket of stocks to represent a particular market or sector.

Q84: If Darby values a soccer ball at

Q123: Suppose that the equilibrium price in the

Q138: Buyers and sellers rarely share the burden

Q170: Refer to Figure 7-13.If the price of

Q203: Market power and externalities are examples of

Q228: Wendy is willing to pay $50 for

Q263: Suppose your own demand curve for tomatoes

Q307: Inefficiency exists in an economy when a

Q345: A tax affects<br>A) buyers only.<br>B) sellers only.<br>C)

Q352: Refer to Figure 7-13.Sellers will be unwilling