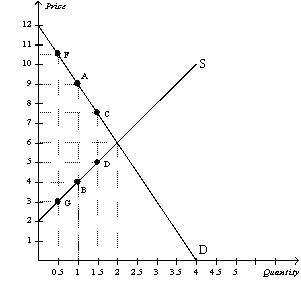

Figure 8-17

The vertical distance between points A and B represents the original tax.

-Refer to Figure 8-17.If the government changed the per-unit tax from $5.00 to $2.50,then the price paid by buyers would be $7.50,the price received by sellers would be $5,and the quantity sold in the market would be 1.5 units.Compared to the original tax rate,this lower tax rate would

Definitions:

Gross Profit

The financial performance metric that subtracts the cost of goods sold (COGS) from revenue, indicating how efficiently a company produces or sources its products.

Gross Margin

The difference between sales revenue and cost of goods sold, shown as a value or percentage, indicating the efficiency of sales relative to production costs.

Gross Sales

Gross sales represent the total sales revenue of a company without any deductions for returns, allowances, or discounts.

Periodic Inventory System

A method of inventory accounting where updates to inventory levels are made periodically at the end of an accounting period, rather than continuously.

Q10: If the tax on gasoline increases from

Q55: Domestic producers of a good become better

Q204: We can say that the allocation of

Q227: In a December 2007 New York Times

Q241: Suppose the Ivory Coast,a small country,imports wheat

Q251: Refer to Figure 8-17.The original tax can

Q271: If a tax did not induce buyers

Q281: Refer to Figure 9-9.Total surplus in this

Q344: The consumption of water by local residents

Q353: If the tax on a good is