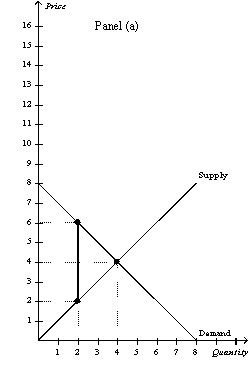

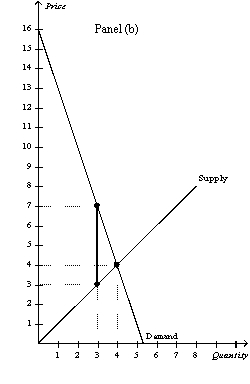

Figure 8-13

-Refer to Figure 8-13.Panel (a) and Panel (b) each illustrate a $4 tax placed on a market.In comparison to Panel (a) ,Panel (b) illustrates which of the following statements?

Definitions:

Willing To Pay

The maximum amount a consumer is prepared to spend on a good or service, reflecting their perceived value or utility.

Price Ceilings

Regulatory limits set on the price that can be charged for certain goods or services, intended to protect consumers from excessive rates.

Price Floors

A minimum price, set by law or agreement, below which a commodity cannot legally be sold, often used in agriculture to stabilize market prices.

Taxes

Compulsory financial charges imposed by a government on individuals, businesses, or transactions to fund public spending.

Q86: Refer to Figure 9-16.The area C +

Q108: If the government imposes a $3 tax

Q203: Refer to Figure 8-6.When the government imposes

Q209: Refer to Figure 8-17.If the government changed

Q228: Refer to Figure 9-1.In the absence of

Q241: Refer to Figure 8-4.The price that sellers

Q302: For any given quantity,the price on a

Q362: The more inelastic are demand and supply,the

Q410: When a tax is levied on the

Q418: Refer to Figure 7-18.Assume demand increases and