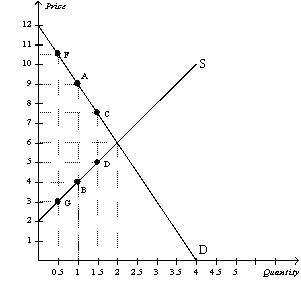

Figure 8-17

The vertical distance between points A and B represents the original tax.

-Refer to Figure 8-17.If the government changed the per-unit tax from $5.00 to $2.50,then the price paid by buyers would be $7.50,the price received by sellers would be $5,and the quantity sold in the market would be 1.5 units.Compared to the original tax rate,this lower tax rate would

Definitions:

Marginal Costs

Marginal costs refer to the increase or decrease in the total cost of producing one more unit of a good or service.

Marginal Productivity

The additional output that results from employing one more unit of input, such as labor or capital, while keeping other inputs constant.

Fixed Costs

Costs that remain constant regardless of the amount of goods produced or sold, like wages or lease payments.

Marginal Costs

The extra expense incurred from making one more unit of a product or service.

Q24: Refer to Figure 8-6.When the tax is

Q27: Refer to Figure 8-2.The loss of consumer

Q66: The nation of Aquilonia has decided to

Q94: Refer to Figure 9-11.Consumer surplus in this

Q109: Refer to Figure 8-11.Suppose Q₁ = 4;

Q208: Refer to Figure 8-9.The imposition of the

Q219: Refer to Figure 8-20.Suppose the figure pertains

Q300: The imposition of a tariff on imported

Q318: When a country that imports a particular

Q330: Refer to Figure 8-4.The per-unit burden of