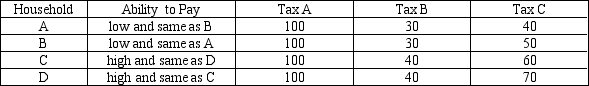

Table 12-16

The table below provides information on the 4 households that make up a small economy and how much they would pay in taxes under 3 types of taxes.

-Refer to Table 12-16.In this economy Tax A exhibits

Definitions:

Capital Balances

The amount of equity ownership that different parties have in a company, typically represented by the shares held or the amount invested in the business.

Withdrawal

The act of taking money out of a bank account, or the removal of assets from a business by the owner for personal use.

Partnership Assets

Assets that are owned by a partnership and are used in the business's operations, typically including things like cash, property, and equipment.

Income Ratios

Metrics that evaluate a company's ability to generate earnings relative to its revenue, equity, assets, or other financial metrics.

Q53: Total taxes paid divided by total income

Q102: When property rights are not well established,<br>A)

Q141: Concerts in arenas are not excludable because

Q173: Phil owns 10 acres of beautiful wooded

Q178: Bert faces a progressive tax structure that

Q261: James earns income of $90,000 per year.His

Q432: State and local governments generate revenue from

Q434: When a firm is making a profit-maximizing

Q448: A lump-sum tax<br>A) is most frequently used

Q459: The U.S.federal government spends its revenues in