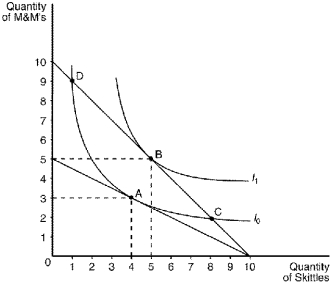

Figure 21-18

-Refer to Figure 21-18.Assume that the consumer depicted in the figure has an income of $20.The price of Skittles is $2 and the price of M&M's is $4.The consumer's optimal choice is point

Definitions:

Taxable Income

The amount of an individual's or a corporation's income used to determine how much tax they owe to the government in a given tax year.

Deductions

Amounts that are subtracted from income before it is subjected to taxation, decreasing the total taxable income amount.

Transfer Payments

Payments made by governments to individuals without any expectation of a direct return or exchange, such as welfare benefits or social security.

Government Spending

Expenditures made by the government in any given period, including on services, salaries, and infrastructure projects.

Q23: The life cycle effect characterizes a lifetime

Q37: Binding minimum-wage laws<br>A) are most effective at

Q43: Refer to Figure 21-12.The marginal rate of

Q81: Economic mobility in the United States is

Q161: The marginal rate of substitution is<br>A) the

Q196: Suppose the average value of in-kind transfers

Q240: Peter was recently hired as a salesman

Q333: A consumer consumes two normal goods,popcorn and

Q365: Carlos goes to the movies every Sunday

Q436: Refer to Figure 21-7.Suppose a consumer has