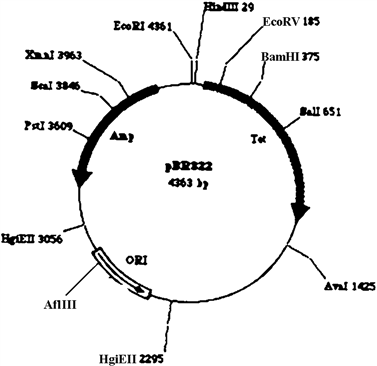

Exhibit 13A This is a map of the pBR322 plasmid, numbers on the map refer to the base where the site is located.  Refer to Exhibit 13A. If the region between the 2 sites for Hgi EII were deleted, the resulting plasmid

Refer to Exhibit 13A. If the region between the 2 sites for Hgi EII were deleted, the resulting plasmid

Definitions:

Deferred Tax Asset

An accounting term for items that can be used to reduce future tax liability when certain conditions are met, such as allowances for doubtful accounts.

Deferred Tax Liability

A tax obligation that arises from temporary differences between the book value and tax value of assets and liabilities, payable in future periods.

Accumulated Depreciation

The total amount of depreciation expense that has been recorded against an asset since it was acquired, reflecting its usage and wear and tear over time.

Tax Purposes

Considerations or actions undertaken in accounting or financial planning to minimize tax liabilities and comply with tax laws.

Q4: When monosaccharides are bonded together<br>A) one H<sub>2</sub>O

Q11: Identify the component of the prokaryotic

Q27: Exhibit 8A <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX8676/.jpg" alt="Exhibit 8A

Q37: The large-T protein of SV40 is an

Q43: Fatty acids with multiple double bonds are

Q54: All the following describe the general mechanism

Q60: Which of the following best describes the

Q60: The HDL class of lipoprotein is generally

Q60: UDP-glucose pyrophosphorylase works by this mechanism:<br>A) It

Q73: A unique feature of the glyoxylate cycle