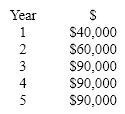

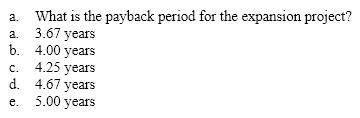

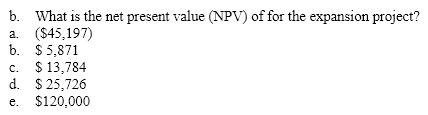

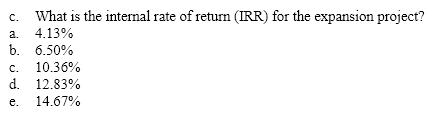

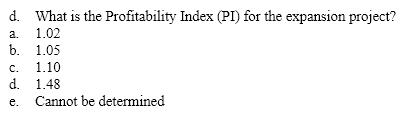

Use the following information for the next four questions. Norlin Corporation is considering an expansion project that will begin next year (Time 0). Norlin's cost of capital is 12%. The initial cost of the project will be $250,000, and it is expected to generate the following cash flows over its five-year life:

Definitions:

Values

Fundamental beliefs or principles that guide an individual's or organization's actions and decisions.

Self-Interests

The focus on one's own benefit or advantage, sometimes disregarding others.

Job Satisfaction

The level of contentment employees feel about their work, including aspects like nature of work, environment, and compensation.

Monetary Compensation

The financial payment received by employees for their labor, including wages, salaries, bonuses, and other financial benefits.

Q21: Because people are less concerned about the

Q24: If a firm issuing additional common equity

Q30: Which of the following is not a

Q52: Risk can be incorporated into capital budgeting

Q57: The relevance of a sunk cost to

Q61: Decision tree analysis let us approximate the

Q82: An investment project requires an outlay of

Q99: Kanick Corp is evaluating a new venture

Q110: The only reason for the difference between

Q172: Decreases in working capital have to be