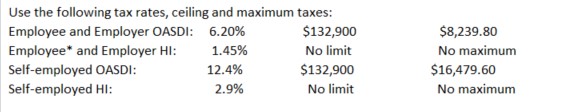

Instruction 3-1  *Employee HI: Plus an additional 0.9% on wages over $200,000. Also applicable to self-employed.

*Employee HI: Plus an additional 0.9% on wages over $200,000. Also applicable to self-employed.

Rounding Rules: Unless instructed otherwise compute hourly rate and overtime rates as follows:

1. Carry the hourly rate and the overtime rate to 3 decimal places and then round off to 2 decimals places (round the hourly rate to 2 decimal places

before multiplying by one and one-half to determine the overtime rate).

2. If the third decimal place is 5 or more, round to the next higher cent.

3. If the third decimal place is less than 5, drop the third decimal place.

Also, use the minimum hourly wage of $7.25 in solving these problems and all that follow.

Refer to Instruction 3-1 . Jax Company's (a monthly depositor) tax liability (amount withheld from employees' wages for federal income tax and FICA tax plus the company's portion of the FICA tax) for July was $1,210.

No deposit was made by the company until August 24, 20-- (9 days late). Determine:

a) The date by which the deposit should have been made

b) The penalty for failure to make timely deposit

c) The penalty for failure to fully pay tax when due

d) The interest on taxes due and unpaid (assume a 5% interest rate)

Definitions:

Two-Factor Theory

A psychological theory, proposed by Herzberg, which suggests that there are two sets of factors that influence job satisfaction: hygiene factors and motivators.

James-Lange Theory

An idea indicating that feelings arise from bodily reactions triggered by situations.

Parasympathetic Arousal

The part of the autonomic nervous system responsible for relaxation and slowing down the body after stress or danger has passed.

Guilty Knowledge Test

A psychological assessment used in forensic psychology to determine whether a person has implicit knowledge about a crime that only the perpetrator could have.

Q1: Under the safe harbor rule, when employers

Q3: When the federal tax deposit is made,

Q4: A cash budget will have value only

Q5: A contract that requires the user to

Q7: A choice of law provision governs <br>A)disputes.<br>B)statutes.<br>C)all

Q12: Companies usually provide a separate column in

Q15: FICA includes partnerships in its definition of

Q31: Even if a state repays its Title

Q73: All employers can grant compensatory time off

Q95: Jean and Jim have liquid assets of