Essay

Instruction 5-1

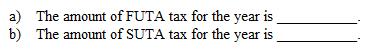

Use the net FUTA tax rate of 0.6% on the first $7,000 of taxable wages.

Refer to Instruction 5-1 . Niemann Company has a SUTA tax rate of 7.1%. The taxable payroll for the year for FUTA and SUTA is $82,600.

Definitions:

Related Questions

Q3: When the federal tax deposit is made,

Q9: The payroll register is used to provide

Q26: Low interest rates:<br>A) increase the number of

Q26: The employers' OASDI portion of FICA taxes

Q42: Exhibit 4-1 : Use the following tables

Q50: Geographic factors affect your earning power.

Q52: Under the FLSA enterprise coverage test, hospitals

Q87: Ben invests $10,000 at a rate of

Q89: Instruction 5-1 <br>Use the net FUTA tax

Q118: Financial planning is necessary only if an