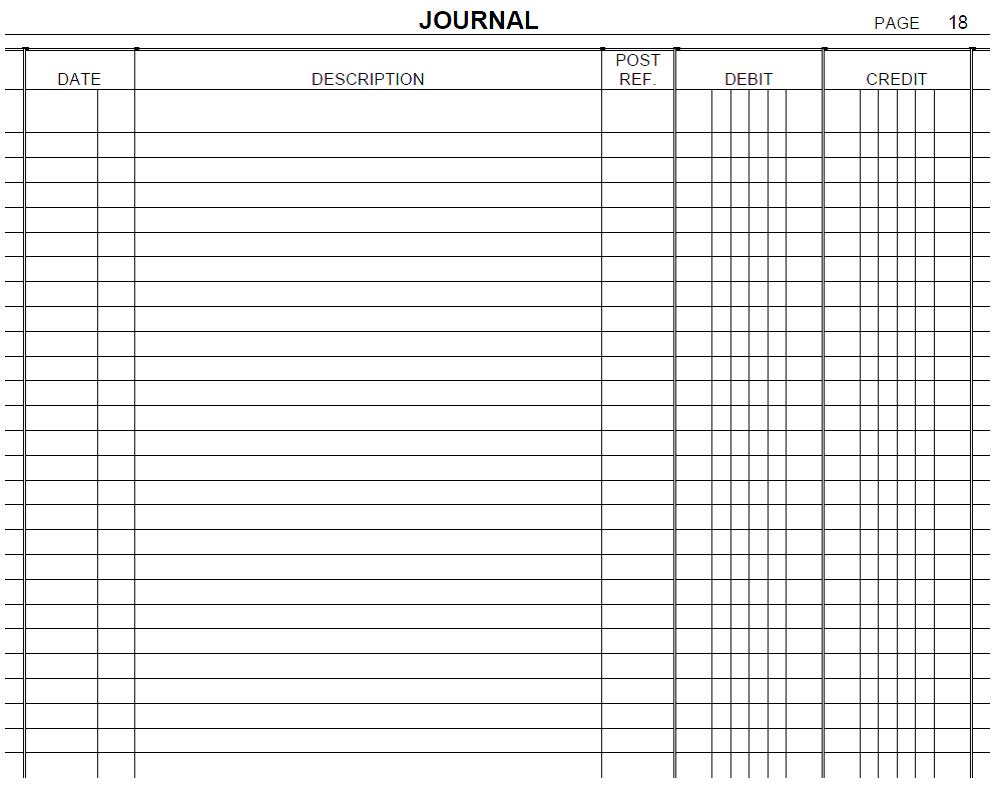

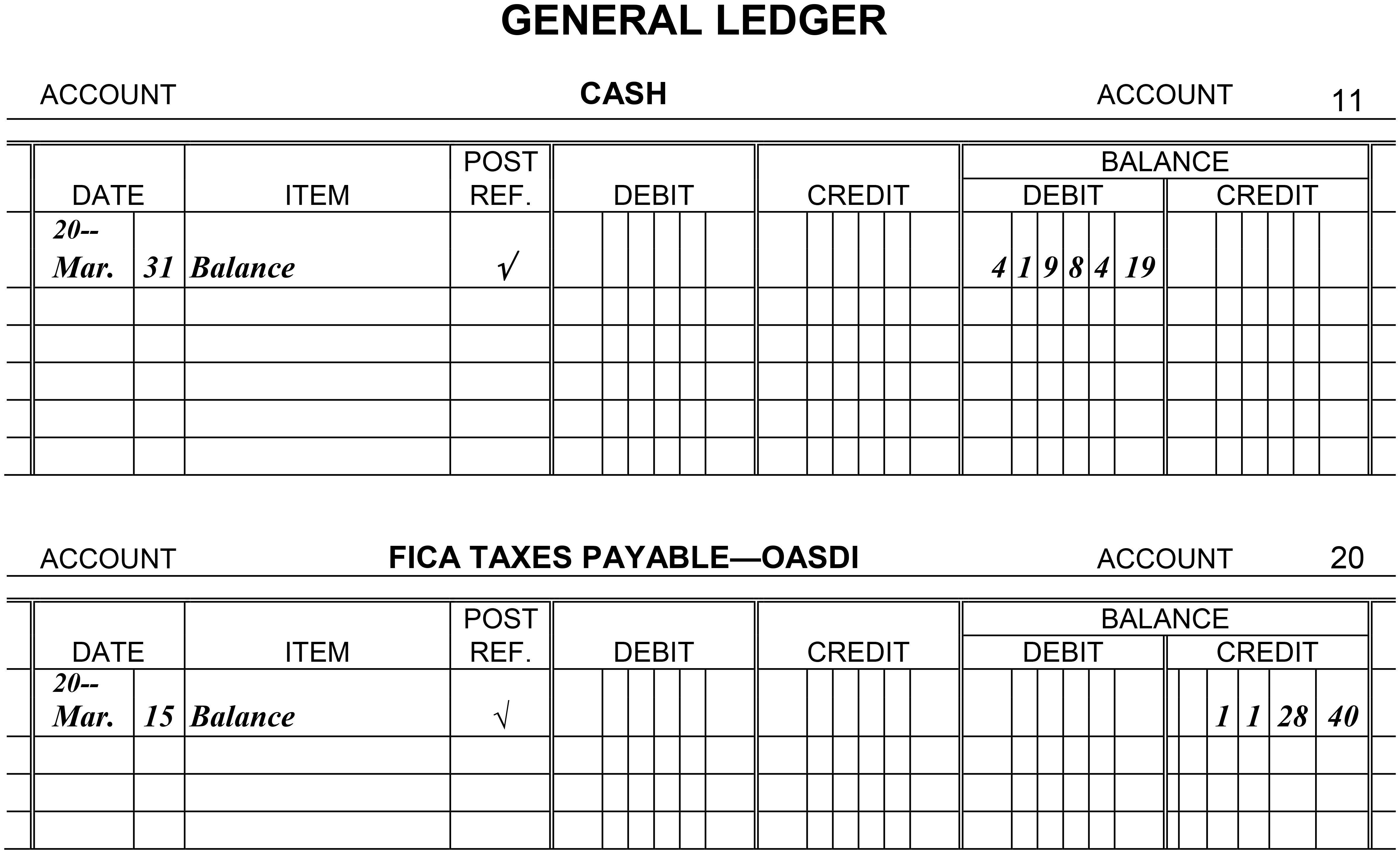

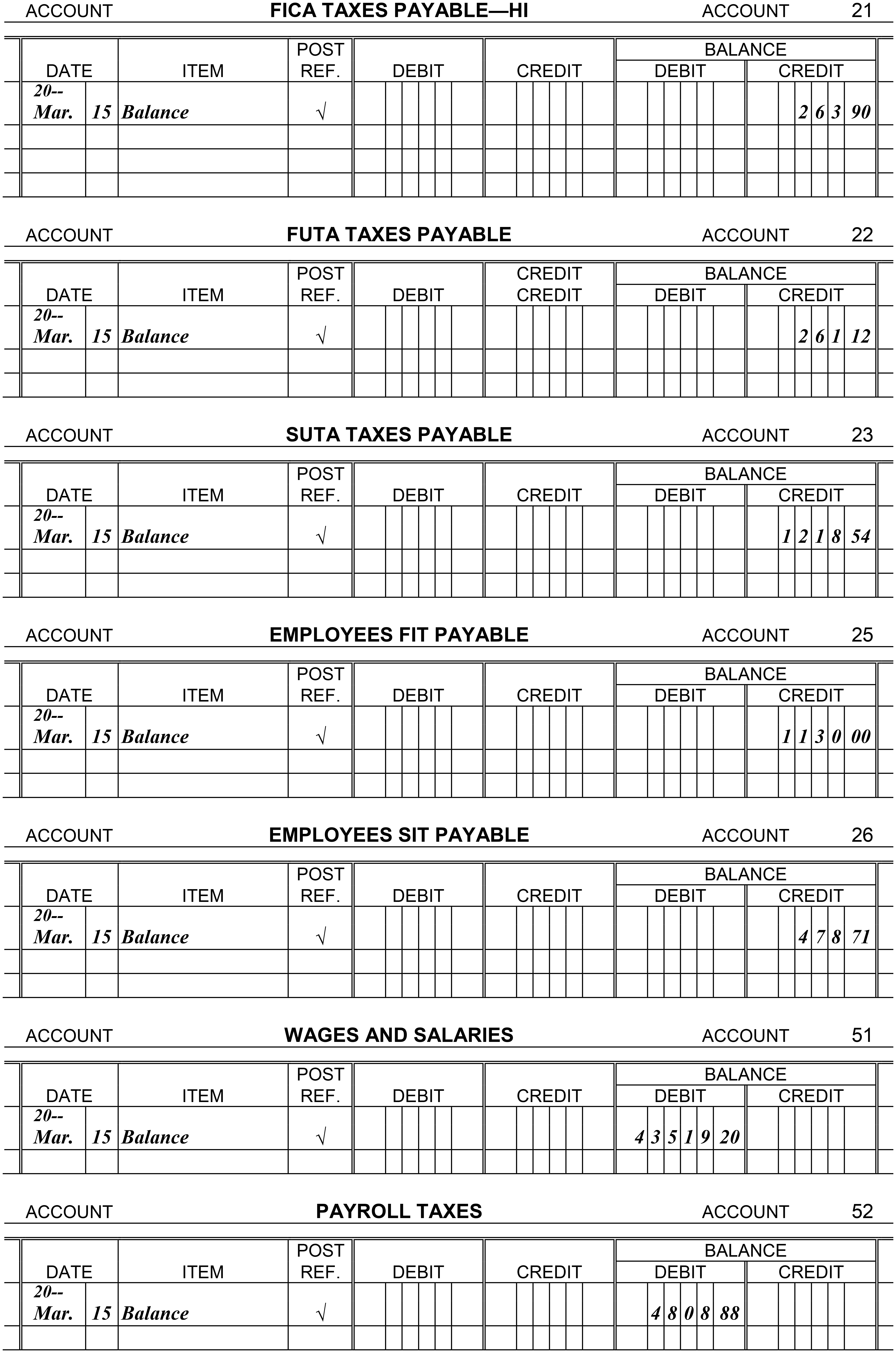

Journalize each of the payroll transactions listed below. Omit the writing of a description or explanation for each journal entry, and do not skip a line between each entry . Then post all entries except the last two to the appropriate general ledger accounts.

The balances listed in the general ledger accounts for Cash, FUTA Taxes Payable, SUTA Taxes Payable, Employees SIT Payable, Wages and Salaries, and Payroll Taxes are the results of all payroll transactions for the first quarter, not including the last pay of the quarter. The balances in FICA Taxes Payable-OASDI, FICA Taxes Payable-HI, and Employees FIT Payable are the amounts due from

the March 15 payroll.

March 31, 20--: Paid total wages of $9,350.00. These are the wages for the last semimonthly pay of March. All of this amount is taxable under FICA (OASDI and HI). In addition, withhold $1,175 for federal income taxes and $102.03 for state income taxes. These are the only deductions made from the employees' wages.

March 31, 20--: Record the employer's payroll taxes for the last pay in March. All of the earnings are taxable under FICA (OASDI and HI), FUTA (0.6%), and SUTA (2.8%).

April 15, 20--: Made a deposit to remove the liability for the FICA taxes and the employees' federal income taxes withheld on the two March payrolls.

May 2, 20--: Made the deposit to remove the liability for FUTA taxes for the first quarter of 20--.

May 2, 20--: Filed the state unemployment contributions return for the first quarter of 20-- and paid the total amount owed for the quarter to the state unemployment compensation fund.

May 2, 20--: Filed the state income tax return for the first quarter of 20-- and paid the total amount owed for the quarter to the state income tax bureau.

December 31, 20--: In July 20--, the company changed from a semimonthly pay system to a weekly pay system. The employees were paid every Friday through the rest of 20--. Record the adjusting entry for wages accrued at the end of December ($770) but not paid until the first Friday in January. Do not post this entry.

December 31, 20--: The company has determined that employees have earned $19,300 in unused vacation time. Record the adjusting entry to put this expense on the books. Do not post this entry.

Definitions:

Posterior Fontanelle

The soft spot at the back of a newborn's skull where the bones have not yet fully joined, allowing for brain growth and skull expansion.

Unsupported

Lacking external assistance, backing, or emotional or structural support, often leading to a feeling of isolation or insufficiency.

Concrete Operations

A stage of cognitive development in children, according to Piaget, where logical thinking develops but is limited to concrete objects and situations.

Piaget's

Refers to the developmental stages and cognitive theory developed by Swiss psychologist Jean Piaget, describing how children's intellect grows through interaction with the environment.

Q7: INSTRUCTIONS: Choose the word or phrase in

Q24: Which of the following statements about money

Q44: The person who is not an authorized

Q52: Under the FLSA enterprise coverage test, hospitals

Q52: The employee's earnings record provides information for

Q69: In the IRA form of a simple

Q71: Which of the following will legally reduce

Q85: The last step in the financial planning

Q89: Instruction 3-1 <br>Use the following tax rates,

Q119: The best way to balance your annual