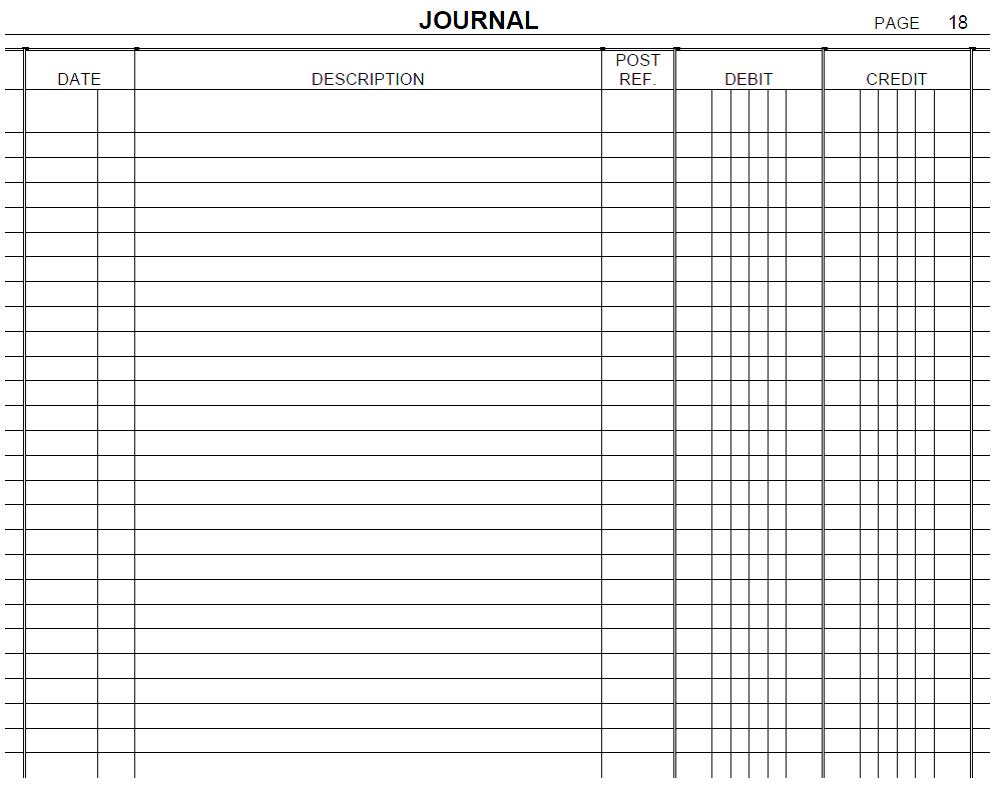

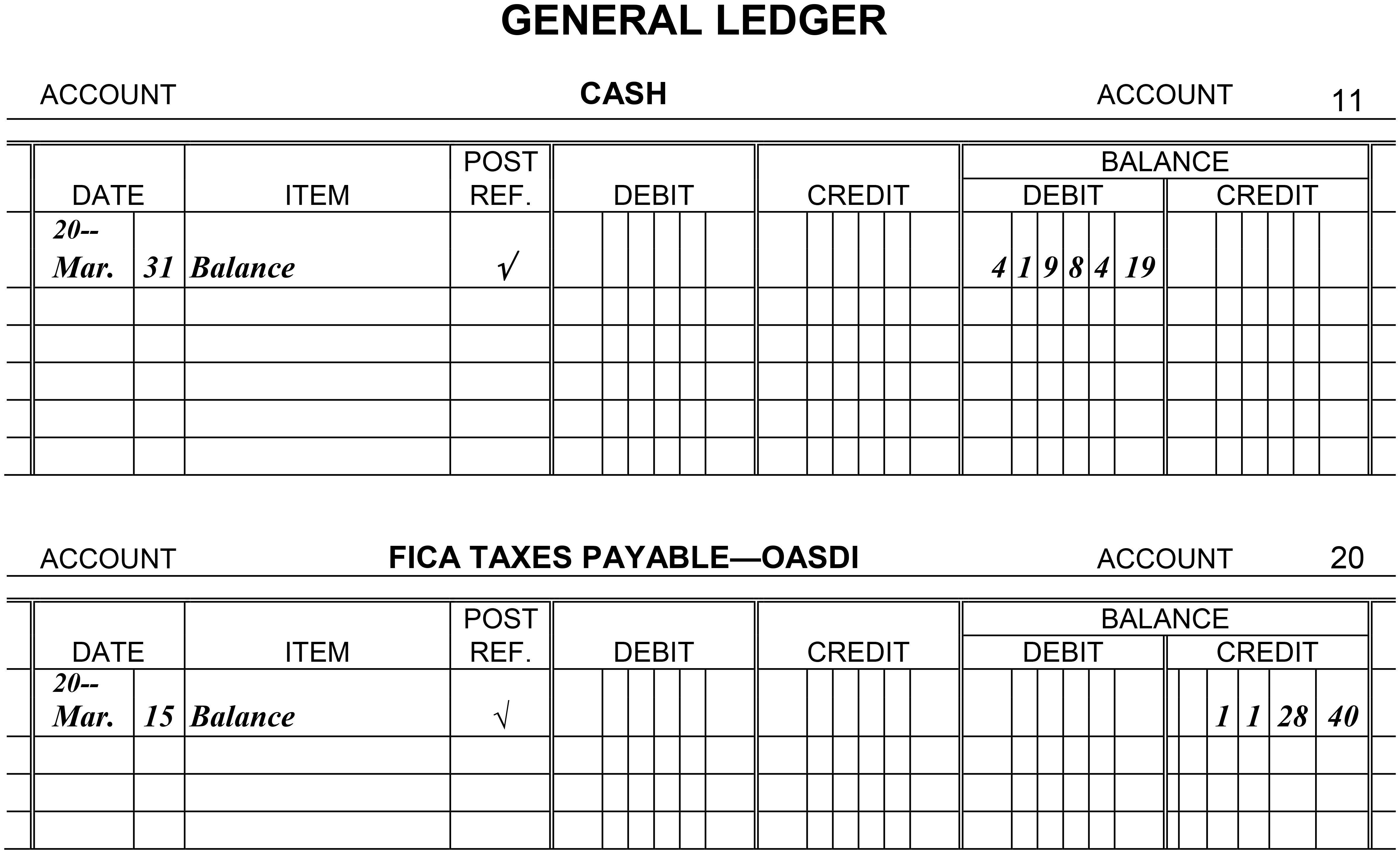

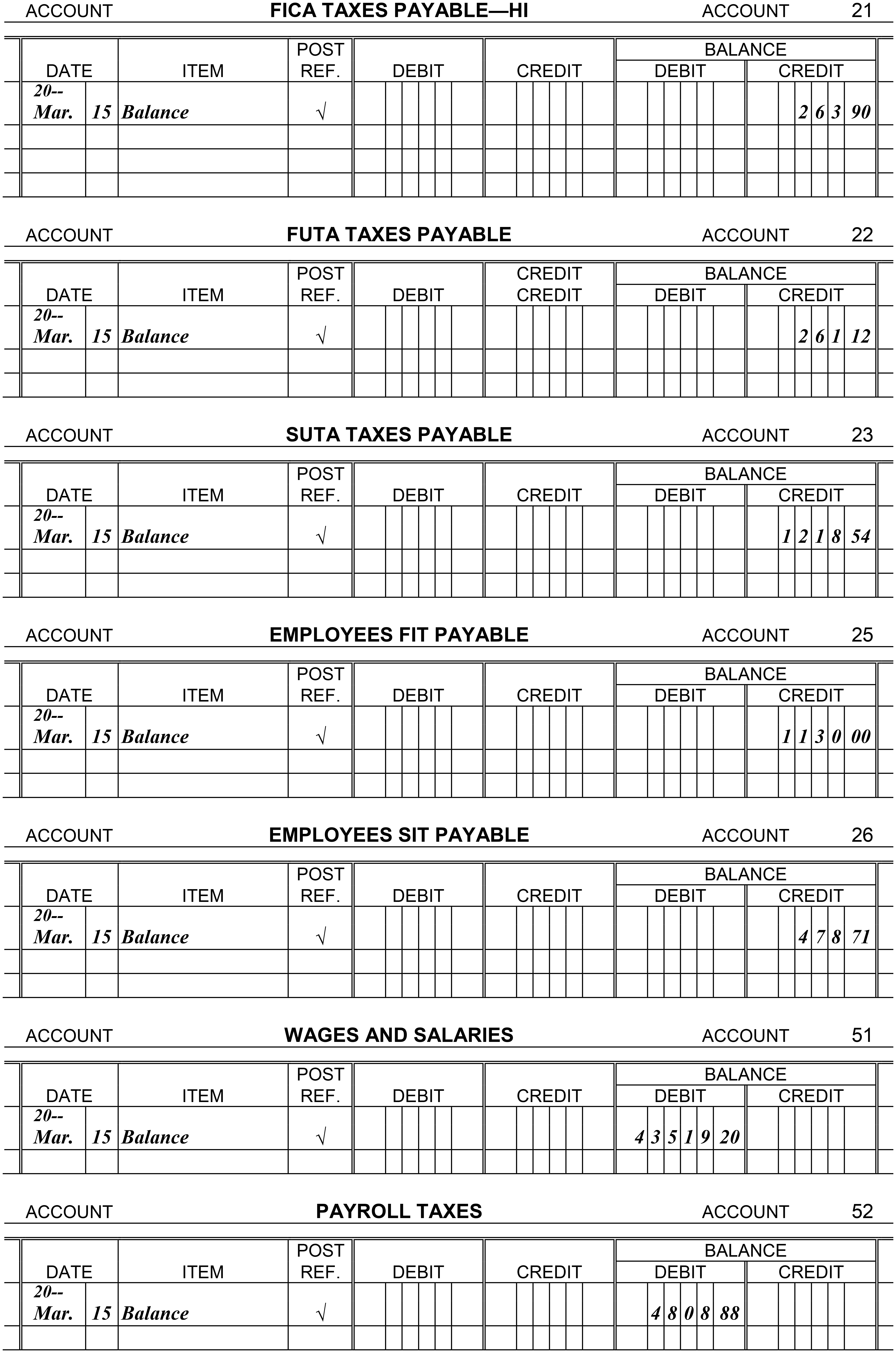

Journalize each of the payroll transactions listed below. Omit the writing of a description or explanation for each journal entry, and do not skip a line between each entry . Then post all entries except the last two to the appropriate general ledger accounts.

The balances listed in the general ledger accounts for Cash, FUTA Taxes Payable, SUTA Taxes Payable, Employees SIT Payable, Wages and Salaries, and Payroll Taxes are the results of all payroll transactions for the first quarter, not including the last pay of the quarter. The balances in FICA Taxes Payable-OASDI, FICA Taxes Payable-HI, and Employees FIT Payable are the amounts due from

the March 15 payroll.

March 31, 20--: Paid total wages of $9,350.00. These are the wages for the last semimonthly pay of March. All of this amount is taxable under FICA (OASDI and HI). In addition, withhold $1,175 for federal income taxes and $102.03 for state income taxes. These are the only deductions made from the employees' wages.

March 31, 20--: Record the employer's payroll taxes for the last pay in March. All of the earnings are taxable under FICA (OASDI and HI), FUTA (0.6%), and SUTA (2.8%).

April 15, 20--: Made a deposit to remove the liability for the FICA taxes and the employees' federal income taxes withheld on the two March payrolls.

May 2, 20--: Made the deposit to remove the liability for FUTA taxes for the first quarter of 20--.

May 2, 20--: Filed the state unemployment contributions return for the first quarter of 20-- and paid the total amount owed for the quarter to the state unemployment compensation fund.

May 2, 20--: Filed the state income tax return for the first quarter of 20-- and paid the total amount owed for the quarter to the state income tax bureau.

December 31, 20--: In July 20--, the company changed from a semimonthly pay system to a weekly pay system. The employees were paid every Friday through the rest of 20--. Record the adjusting entry for wages accrued at the end of December ($770) but not paid until the first Friday in January. Do not post this entry.

December 31, 20--: The company has determined that employees have earned $19,300 in unused vacation time. Record the adjusting entry to put this expense on the books. Do not post this entry.

Definitions:

Variable Costing

An accounting method that considers only variable costs in calculating the cost of goods sold and determines contribution margin.

Fixed Overhead

Costs that do not change with the level of production activity, such as rent, salaries, and insurance.

Operating Income

Earnings from a company's core business operations, excluding expenses and revenues from non-operational activities like investment income.

Absorption Costing

A costing method that includes all manufacturing costs—direct materials, direct labor, and both variable and fixed manufacturing overhead—in the cost of a product.

Q1: Which of the following is not an

Q12: Although commissions are considered payments for hours

Q32: Instructions : Choose the word or phrase

Q37: Federal tax levies are not subject to

Q48: Which of the following is listed as

Q58: Instruction 5-1 <br>Use the net FUTA tax

Q58: The amount of goods and services each

Q74: Mark is not married and has dependent

Q105: Instruction 2-2 <br>Carry each hourly rate and

Q111: The longer you wait to begin retirement