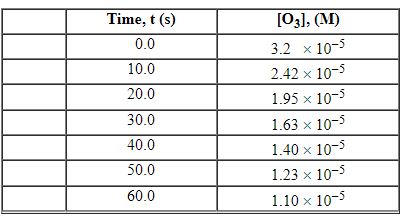

Exhibit 13-3 Consider the following reaction and the corresponding time-concentration table to answer the following question(s) . C2H4 (g) + O3 (g) →C2H4O (g) + O2 (g) The concentration of ozone, O3, was monitored for this reaction as a function of time and is given in the table that follows

-Refer to Exhibit 13-3. What is the average rate for the time interval from 20.0 seconds tO60.0 seconds?

Definitions:

Accrued Interest

Interest that has been earned but not yet received or recorded as of a particular date.

Bond Purchase

The acquisition of debt securities issued by corporations or governments, representing a loan made by the investor to the issuer.

Equity Securities

Financial instruments representing ownership interest in a company, such as stocks.

Debt Securities

Financial instruments representing a loan made by an investor to a borrower, typically involving periodic interest payments and the return of principal at maturity.

Q1: What is the name of the cubic

Q13: What type of crystal would CO<sub>2</sub> form

Q14: What bonded atom lone pair arrangement is

Q20: An acid HB<sup>+</sup> has a K <sub>a</sub>

Q41: Refer to Exhibit 11-4. What is the

Q74: What molecular shape would you predict for

Q77: The equilibrium constant for the reaction below

Q116: The presence of a nonvolatile solute in

Q145: Consider the following Bronsted-Lowery acid-base reaction:<br>HClO ₂

Q159: Arrange the following aqueous solutions in order