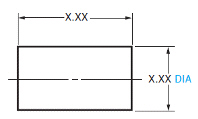

Describe the model displayed in the accompanying figure and explain the subsystems that might be involved in the model.

Describe the model displayed in the accompanying figure and explain the subsystems that might be involved in the model.

Definitions:

Price-Earnings Ratio

A valuation ratio comparing a company’s current share price to its per-share earnings, helping investors evaluate if a stock is over or under-valued.

Net Profit Margin

A financial ratio that shows the percentage of net income generated from total revenue.

Gross Margin

The difference between sales revenue and the cost of goods sold, representing the profitability before deducting operating expenses.

Return On Total Assets

A financial ratio that measures the net income produced by total assets during a period by comparing net income to the average total assets.

Q4: What is a three-view drawing?

Q4: The types of lines commonly found on

Q6: In a single-point or _ perspective, one

Q6: _ line dimensions simplify the reading of

Q6: A rectangular prism is 21 3/32 inches

Q9: A machinist can make 24 screws in

Q9: Explain decimal tolerances.

Q10: _ lines are thin, unbroken lines projected

Q10: A strip of 7/16-inch metal is 166

Q11: The right-side and left-side isometric base lines