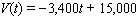

Straight-line depreciation is an accounting method used to help spread the cost of new equipment over a number of years. It takes into account both the cost when new and the salvage value, which is the value of the equipment at the time it gets replaced. The function  where V is value and t is time in years, can be used to find the value of a large copy machine during the first 4 years of use. After how many years will the copier be worth only $7,000? Round your answer to the nearest hundredth.

where V is value and t is time in years, can be used to find the value of a large copy machine during the first 4 years of use. After how many years will the copier be worth only $7,000? Round your answer to the nearest hundredth.  __________ years

__________ years

Definitions:

Ethical Action

Actions conducted with consideration for what is morally right and good, often guided by ethical principles in personal, professional, or social contexts.

Situations

Refers to set of conditions or circumstances pertinent to a specific context or environment.

Machine Learning

A subset of artificial intelligence that involves the use of algorithms and statistical models to enable computers to perform tasks without explicit instructions, by relying on patterns and inference.

Artificial Intelligence

The simulation of human intelligence processes by machines, especially computer systems, including the ability to learn, reason, and adapt to new situations.

Q16: Simplify the complex fraction. <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX8808/.jpg" alt="Simplify

Q71: Let <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX8808/.jpg" alt="Let Evaluate

Q82: Write the number in terms of i

Q90: Rationalize the denominator in the following expression.

Q117: Straight-line depreciation is an accounting method used

Q136: Write <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX8808/.jpg" alt="Write as

Q156: Solve the equation. Use factoring or the

Q206: Solve the system. <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX8808/.jpg" alt="Solve the

Q215: Solve the inequality and graph the solution

Q258: Combine the expressions. (Assume the variables are