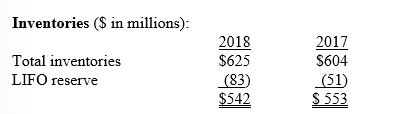

Spando Apparel uses the LIFO inventory method for external reporting and for income tax purposes but maintains its internal records using FIFO. The following disclosure note was included in a recent annual report:

The company's income statement reported cost of goods sold of $3,120 million for the fiscal year ended December 31, 2018.

Required:

1. Spando adjusts the LIFO reserve at the end of its fiscal year. Prepare the December 31, 2018, adjusting entry to record the cost of goods sold adjustment.

2. If Spando had used FIFO to value its inventories, what would cost of goods sold have been for the 2018 fiscal year?

Definitions:

Sales Promotion Expenditures

The financial investment allocated towards marketing strategies and campaigns designed to increase immediate consumer demand and stimulate sales of a product or service.

Consumer-Oriented Sales Promotions

Marketing strategies aimed at inducing consumers directly to purchase products through methods such as coupons, discounts, and contests.

Coupons

Vouchers or codes that offer a discount or deal, used as a promotional strategy to encourage consumers to try a product or service.

Premiums

Goods offered for free or at a low cost as an incentive to purchase a product or service.

Q9: Recognizing sales returns only when merchandise is

Q14: Littleton Company uses a periodic inventory system

Q29: In December of 2018, XL Computer's internal

Q32: Bill wants to give Maria a $500,000

Q50: Tom's Textiles shipped the wrong material to

Q58: Belushi, Inc. owes Cusack County Trust $40

Q92: Cordova, Inc., reported the following receivables in

Q92: White & Decker Corporation's 2018 financial

Q148: Patty's Pet Store purchased merchandise on October

Q150: Which of the following is considered a