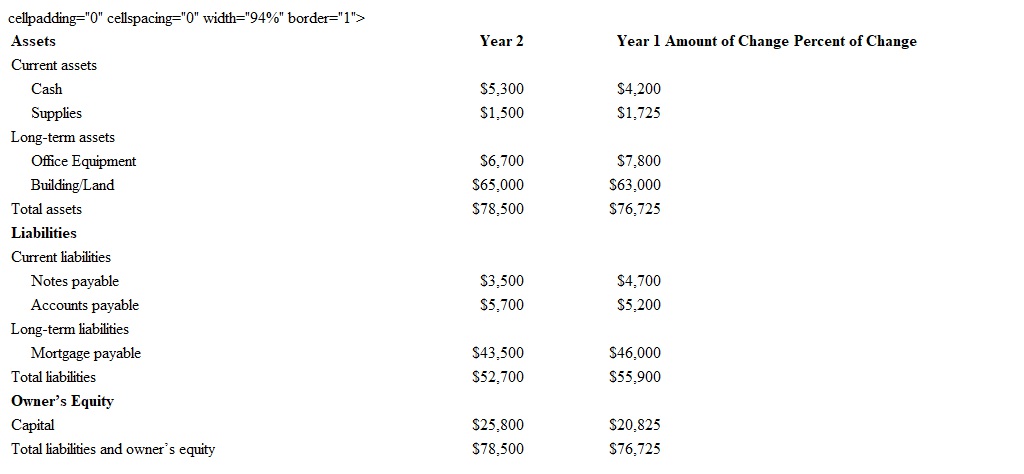

Below is a partially completed horizontal analysis of a balance sheet.

Rachel is completing a comparative analysis of her business' balance sheet. What is the amount and percent of change in building/land from Year 1 to Year 2 for Rachels Candle Company?

Rachel is completing a comparative analysis of her business' balance sheet. What is the amount and percent of change in building/land from Year 1 to Year 2 for Rachels Candle Company?

Definitions:

Child And Dependent Care Credit

A tax credit in the U.S. for eligible expenses related to the care of a child or dependent, making it easier for caregivers to work or look for work.

Earned Income

Income derived from active participation in a business, including wages, salaries, tips, and other compensation.

Education Credit Deduction

A tax benefit that reduces the amount of income tax owed by individuals paying for higher education expenses.

Qualified Expenses

Costs recognized by the IRS for specific tax benefits, such as education-related expenses eligible for tax credits.

Q2: What is the maturity value of a

Q7: A company reports net earnings of $3.10

Q28: Find the quotient. <span class="ql-formula"

Q33: In the last four weeks, Case Janson

Q35: On the 1st of the month, the

Q47: The selling price of a pair of

Q51: A low-income worker who qualifies for the

Q54: What is the difference between the exact

Q72: Factor <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX8671/.jpg" alt="Factor into

Q75: Solve the equation. <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX8671/.jpg" alt="Solve the