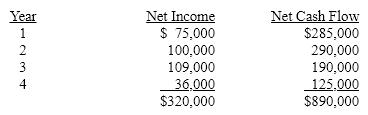

Dickerson Co. is evaluating a project requiring a capital expenditure of $810,000. The project has an estimated life of 4 years and no salvage value. The estimated net income and net cash flow from the project are as follows:

The company's minimum desired rate of return is 12%. The present value of $1 at compound interest of 12% for 1, 2, 3, and 4 years is 0.893, 0.797, 0.712, and 0.636, respectively.

Determine the average rate of return on investment, including the effect of depreciation on the investment.

Definitions:

Expansionary Gap

An Expansionary Gap exists when an economy’s output exceeds its potential output, often leading to inflationary pressures.

Aggregate Demand

The aggregate need for commodities and services inside an economy at a specific general price level over a particular time frame.

Corporate Income Taxes

Taxes imposed on the net income (profits) of corporations, calculated based on tax rates that vary by jurisdiction.

Government Borrowing

The act of the state borrowing money, often by issuing securities like bonds, to fund its expenditures beyond its income.

Q3: For each of the following, identify whether

Q12: In determining the cash flows from operating

Q38: Which of the following is an example

Q41: During the years 1994 to 2007 seat

Q58: The population of Florida is given in

Q78: Which of the following would not be

Q109: A bottleneck happens when a key piece

Q118: Cost-plus methods determine the normal selling price

Q122: A $400,000 capital investment proposal has an

Q136: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX9037/.jpg" alt=" Based on the