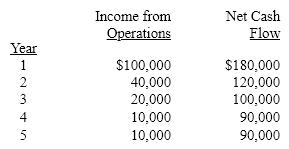

The management of California Corporation is considering the purchase of a new machine costing $400,000. The company's desired rate of return is 10%. The present value factors for $1 at compound interest of 10% for 1 through 5 years are 0.909, 0.826, 0.751, 0.683, and 0.621, respectively. In addition to the foregoing information, use the following data in determining the acceptability of this investment:  The present value index for this investment is

The present value index for this investment is

Definitions:

Demand Function

A mathematical formula that describes the relationship between the quantity of a good demanded and its price, along with other factors such as income and price of related goods.

Market Share

The percentage of total sales in a market captured by one company or product.

Perceived Market

This term suggests a market as understood or interpreted by individuals or businesses, which may not accurately reflect the actual market structure or dynamics. NO.

Demand Function

A mathematical formula that describes the relationship between the quantity of a good demanded and its various determinants like price, income, and prices of related goods.

Q14: Given the data set draw a scatterplot.

Q16: Average rate of return equals average investment

Q27: If two companies have the same current

Q28: The net present value has been computed

Q40: If a company has issued only one

Q55: Sage Company is operating at 90% of

Q72: In a push manufacturing system, raw materials

Q110: The current period statement of cash flows

Q149: Heidi Company is considering the acquisition of

Q159: Norton Company is considering a project that