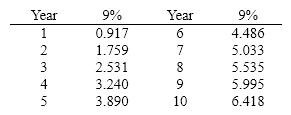

Norton Company is considering a project that will require an initial investment of $750,000 and will return $200,000 each year for 5- years.

(a) If taxes are ignored and the required rate of return is 9%, what is the project's net present value?

(b) Based on this analysis, should Norton Company proceed with the project?

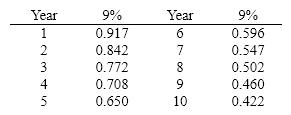

Below is a table for the present value of $1 at compound interest.

Below is a table for the present value of an annuity of $1 at compound interest.

Definitions:

Hyperactivity

Characterized by an excess of movement and/or quick actions that are not fitting to the setting or context, often associated with ADHD.

Apprehensive Expectations

Feelings of anxiety or fear about future events or outcomes, often anticipating negative or unfavorable results.

Generalized Anxiety Disorder

A mental health disorder characterized by persistent and excessive worry about a variety of topics, often interfering with daily activities.

Development

The pattern of continuity and change in human capabilities that occurs throughout life, involving both growth and decline.

Q7: Durrand Corporation's accumulated depreciation increased by $12,000,

Q39: Identify which section the statement of cash

Q43: Which of the following would not be

Q51: Solve the quadratic equation by using the

Q58: The lean philosophy attempts to reduce setup

Q64: A company can use comparisons of its

Q65: A present value index can be used

Q66: The average profit in dollars A that

Q149: Kennedy, Inc. reported the following data: <img

Q159: Norton Company is considering a project that