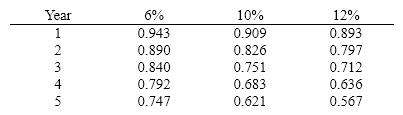

Below is a table for the present value of $1 at compound interest.

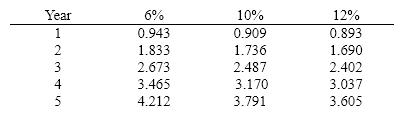

Below is a table for the present value of an annuity of $1 at compound interest.

Using the tables above, what would be the internal rate of return of an investment of $210,600 that would generate an annual cash inflow of $50,000 for the next 5 years?

Definitions:

Default Risk

The possibility that a borrower will fail to meet the obligations of a debt agreement.

Adjustable Maturity Dates

Adjustable maturity dates refer to the flexibility allowed in the due dates of financial instruments, allowing for changes in the repayment schedule.

Floating-Rate Bonds

Bonds with variable interest rates that adjust periodically based on a benchmark interest rate or index.

Coupon Rate

The interest payment made annually on a bond, shown in percentage terms of its face value.

Q17: Kilbuck Manufacturing operates in a lean manufacturing

Q35: Make-to-order companies typically produce in small batch

Q41: Which of the following is best suited

Q66: The production department is proposing the purchase

Q94: The current ratio is<br>A) used to evaluate

Q98: Flyer Company sells a product in a

Q107: Balances of the current asset and current

Q107: The management of River Corporation is considering

Q142: Which of the following should be shown

Q151: Target costing is arrived at by taking<br>A)