A project has estimated annual cash flows of $95,000 for 4 years and is estimated to cost $260,000. Assume a minimum acceptable rate of return of 10%. Using the following tables determine the (a) net present value of the project and (b) the present value index, rounded to two decimal places.

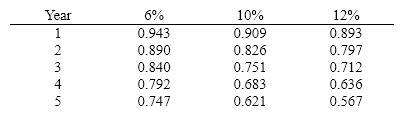

Below is a table for the present value of $1 at compound interest.

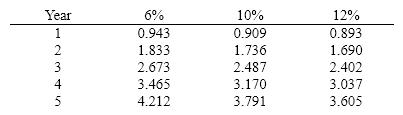

Below is a table for the present value of an annuity of $1 at compound interest.

Definitions:

Goal-setting Theory

A framework that suggests specific, challenging goals along with appropriate feedback contribute to higher and better task performance.

Comparable Worth

The concept that jobs of equal value to an organization should receive equal pay, regardless of the gender or minority status of the job holders.

Valence

The value an individual places on the expected outcome of an action or behavior, which can influence their motivation.

Instrumentality

In the context of motivation theory, the belief that a certain behavior will lead to achieving a desired outcome or reward.

Q10: The expected period of time that will

Q34: During the years 1994 to 2007 seat

Q70: Which of the following should be added

Q75: Solve the quadratic equation. Give both the

Q100: When several alternative investment proposals of the

Q102: The Swan Company produces its product at

Q114: Long setups and large batch sizes result

Q132: The effects of differences in accounting methods

Q150: In calculating the net present value of

Q158: Which of the following would appear as