Project A requires an original investment of $65,000. The project will yield cash flows of $15,000 per year for 7 years. Project B has a calculated net present value of $5,500 over a 5-year life. Project A could be sold at the end of 5 years for a price of $30,000. (a) Using the table below, determine the net present value of Project A over a 5-year life with salvage value assuming a minimum rate of return of 12%. (b) Which project provides the greatest net present value?

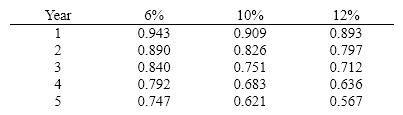

Below is a table for the present value of $1 at compound interest.

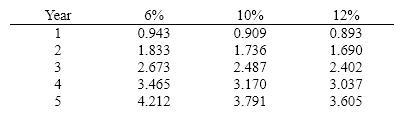

Below is a table for the present value of an annuity of $1 at compound interest.

Definitions:

Variable Cost

Expenses that change in proportion to the activity of a business.

Mud Statues

Refers specifically to figures crafted from earth materials like clay, often in a cultural or artistic context, but remains unrelated to economic jargon.

Total Cost

The complete expense incurred in the production of goods or services, including both fixed and variable costs.

Loan

Borrowed money that is expected to be paid back with interest.

Q1: The amount of the average investment for

Q22: For each of the following, identify whether

Q39: Which of the following is not a

Q58: The lean philosophy attempts to reduce setup

Q91: In using the variable cost concept of

Q95: Mallard Corporation uses the product cost concept

Q104: Using the indirect method, if land costing

Q127: The management of River Corporation is considering

Q148: Make-or-buy decisions should be made only with

Q166: Dickerson Co. is evaluating a project requiring