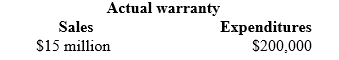

Fusion, Inc. introduced a new line of circuits in 2018 that carry a four-year warranty against manufacturer's defects. Based on experience with previous product introductions, warranty costs are expected to approximate 3% of sales. Sales and actual warranty expenditures for the first year of selling the product were:

Required:

1. Does this situation represent a loss contingency? Why or why not? How should it be accounted for?

2. Prepare journal entries that summarize sales of the circuits (assume all credit sales) and any aspects of the warranty that should be recorded during 2018.

3. What amount should Fusion report as a liability at December 31, 2018?

Definitions:

Merchandise Inventory

Items that a company holds for the purpose of resale to customers in the ordinary course of business.

Gross Method

An accounting approach for recording purchases at the invoice price without deduction of any cash discounts offered.

Perpetual Inventory System

A strategy for managing inventory accounting that utilizes computerized point-of-sale systems and enterprise asset management software to immediately document sales or purchases.

Accounts Payable

Obligations a business has to its creditors, arising from the purchase of goods and services on credit.

Q22: Cracker Corporation began a special promotion in

Q32: On January 1, 2016, Al's Sporting Goods

Q41: How much cash interest does Auerbach pay

Q43: Ocean Adventures issues bonds due in 10

Q50: The three factors in cost allocation of

Q89: Kelly Industries issued 11% bonds, dated January

Q137: Kelly Company and its subsidiaries are engaged

Q143: Concept 1 Office Products sells office electronics

Q143: If an investment is accounted for under

Q179: The table below contains data on depreciation