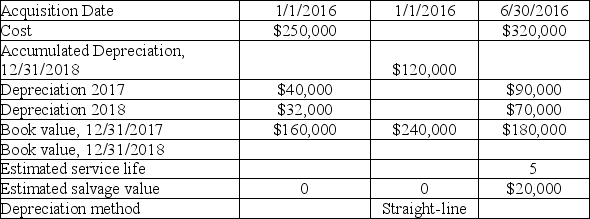

The table below contains data on depreciation for machinery.

Required: Fill in the missing data in the table.

Definitions:

GAAS

Generally Accepted Auditing Standards, which are guidelines that auditors follow when conducting audits on companies' finances.

GAAP

Generally Accepted Accounting Principles, which are a common set of accounting rules and standards for financial reporting.

Sarbanes-Oxley Act

A U.S. law enacted in 2002 aimed at improving corporate governance and accountability through stricter auditing and financial regulations.

Non-Auditing Acts

Activities performed by accounting firms or professionals that do not involve the examination of financial records for the purpose of expressing an opinion on their fairness.

Q21: Red Co. can estimate the amount of

Q38: If Dizbert Company concluded that an investment

Q54: Briefly explain the differences between U.S. GAAP

Q71: Which depreciation method is most common for

Q78: Panther Co. had a quality-assurance warranty liability

Q102: Wicker Corporation operates a manufacturing plant in

Q114: In applying the lower of cost

Q119: Required: Compute the January 31 ending inventory

Q177: Assume Cold Cat did not purchase any

Q181: Using the sum-of-the-years'-digits method, depreciation for 2018