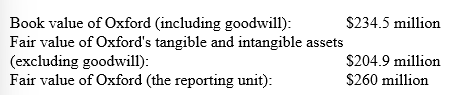

In 2017, Dooling Corporation acquired Oxford Inc. for $250 million, of which $50 million was attributed to goodwill. At the end of 2018, Dooling's accountants derive the following information for a required goodwill impairment test:

-Assume the same facts as above, except that the fair value of Oxford (the reporting unit) is $225 million.

Required: Determine the amount, if any, of the goodwill impairment loss that Dooling must recognize on these assets.

Definitions:

Net Income

The net earnings of a company once all costs and taxes are subtracted from the total income.

Stockholders' Equity

Stockholders' equity represents the owners' claim after subtracting total liabilities from total assets, indicating the net worth of a company from the shareholders' perspective.

Stockholders' Equity

The residual interest in the assets of a corporation after deducting its liabilities, representing the ownership stake of the shareholders.

Additional Paid-in Capital

The excess amount paid by investors over and above the par value of the shares during the issuance of stock.

Q4: Prepare summary journal entries that Fragrance International

Q8: A quality-assurance warranty typically results in the

Q79: The primary motivation behind the lower of

Q92: At the beginning of 2018, Angel Corporation

Q98: Assets acquired under multi-year deferred payment contracts

Q99: Z Co. filed suit against W Inc.

Q109: Comet Cleaning Co. reported the following on

Q128: Sanders Corporation operates a factory in Arizona.

Q135: A company had the following expenditures related

Q165: The income statement reports changes in fair