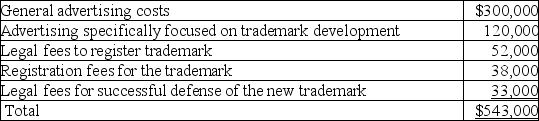

A company had the following expenditures related to developing its trademark.  During your year-end review of the accounts related to intangibles, you discover that the company has capitalized all the above as costs of the trademark. Management contends that all of the costs increase the value of the trademark; therefore, all the costs should be capitalized.

During your year-end review of the accounts related to intangibles, you discover that the company has capitalized all the above as costs of the trademark. Management contends that all of the costs increase the value of the trademark; therefore, all the costs should be capitalized.

Required:

1. Which of the above costs should the company capitalize to the Trademark account in the balance sheet?

2. Which of the above costs should the company report as expense in the income statement?

Definitions:

Part-Time Workers

Refers to individuals who are regularly expected to work less than 40 hours a week. They typically do not receive benefits and afford the organization a great deal of flexibility in staffing.

Scheduling Flexibility

Scheduling flexibility refers to the ability of employees to have control over their work hours, including when and where they work, often aimed at improving work-life balance.

Labor Costs

The total sum of all wages paid to employees, as well as the costs related to employee benefits and payroll taxes.

Progressive Disciplinary

A gradual approach to disciplining employees for policy violations, typically starting with a warning and escalating to more severe consequences.

Q19: Net realizable value is selling price less

Q43: When the investor's level of influence changes,

Q57: New York Sales Inc. uses the conventional

Q57: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2599/.jpg" alt=" " class="answers-bank-image d-block" rel="preload"

Q127: Rice Industries owns a manufacturing plant in

Q130: On April 23, 2018, Trevors Mining

Q137: Rockport Refinery acquired all the outstanding

Q178: What gain or loss would be realized

Q199: Using the sum-of-the-years'-digits method, depreciation for 2018

Q205: The allocation base of an asset refers