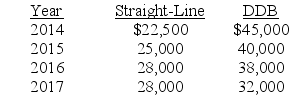

Weaver Textiles Inc. has used the straight-line method to depreciate its equipment since it started business in 2014. At the beginning of 2018, the company decided to change to the double-declining-balance (DDB) method. Depreciation as reported and as it would have been reported if the company had always used DDB is listed below:  Required:

Required:

What journal entry, if any, should Weaver make to record the effect of the accounting change (ignore income taxes)? Explain.

Definitions:

Output Per Worker

The average quantity of goods and services produced per employee in a given time period.

Economic Growth

An increase in the production of goods and services in an economy over a period of time, often measured by GDP growth.

Simon Kuznets

A Ukrainian-American economist who made significant contributions to the study of economic growth, the development of the concept of Gross National Product, and the statistical analysis of economic cycles.

Automobile Industry

A sector of the economy that deals with the design, production, and selling of motor vehicles.

Q29: Calegari Mining paid $2 million to obtain

Q36: Purchase returns and purchase discounts are ignored

Q37: Which of the following typically refers to

Q41: In testing for recoverability of property, plant,

Q65: Montana Co. has determined its year-end

Q78: Required: Determine the reported inventory value assuming

Q104: A company should accrue a loss contingency

Q113: What should be the reported value of

Q125: Physical flow<br>A)Units grouped according to similarities.<br>B)Captured by

Q133: Short Corporation acquired Hathaway, Inc., for $52,000,000.