Use the following to answer questions

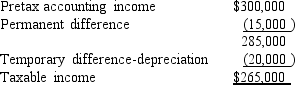

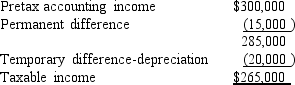

For its first year of operations,Tringali Corporation's reconciliation of pretax accounting income to taxable income is as follows:

Tringali's tax rate is 40%.Assume that no estimated taxes have been paid.

Tringali's tax rate is 40%.Assume that no estimated taxes have been paid.

-

Tringali's tax rate is 40%.

What should Tringali report as its income tax expense for its first year of operations?

Definitions:

Antidepressants

Medications used to treat depression and other mental health conditions by regulating neurotransmitter levels in the brain.

Borderline Personality Disorder

A psychological condition marked by widespread fluctuation in emotions, social interactions, self-perception, and actions.

MAOIs

A class of antidepressant drugs that work by inhibiting the action of monoamine oxidase, an enzyme that breaks down neurotransmitters in the brain.

STEPPS

Systems Training for Emotional Predictability and Problem Solving, a group therapy program designed for individuals with borderline personality disorder or emotional regulation problems.

Q29: Which of the following circumstances creates a

Q29: When a lease qualifies as a capital

Q33: Why are the depreciation and patent amortization

Q40: The shareholders' equity of Nick Co.includes the

Q40: Current liabilities normally are recorded at their:<br>A)Present

Q68: On January 1,2016,Wellburn Corporation leased an asset

Q69: A statement of comprehensive income does not

Q92: Prepare a list of how retiree health

Q121: The valuation allowance account that is used

Q138: Capital Consulting Company had 400,000 shares of