Use the following to answer questions

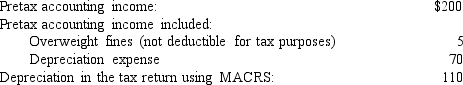

The following information relates to Franklin Freightways for its first year of operations (data in millions of dollars) :

The applicable tax rate is 40%.There are no other temporary or permanent differences.

The applicable tax rate is 40%.There are no other temporary or permanent differences.

-Franklin's net income ($ in millions) is:

Definitions:

Alamo Mission

A historic Spanish mission and fortress compound in San Antonio, Texas, famous for the battle of the Alamo during the Texas Revolution.

Texas Independence

The process by which the region of Texas declared and achieved independence from Mexico in 1836, later becoming an independent republic before joining the United States.

Santa Anna

A Mexican politician and general who played a key role in Mexico's history in the early 19th century, including during the Texas Revolution and the Mexican-American War.

Battle Of San Jacinto

The decisive battle of the Texas Revolution fought in 1836, where Texas forces defeated Mexican troops, leading to Texas independence.

Q11: Listed below are several terms and phrases

Q16: For the current year ($ in millions),Centipede

Q20: Franklin's balance sheet at the end of

Q30: On December 31,2015,Belair Corporation had 100,000 shares

Q55: Which of the following is not a

Q78: The Model Business Corporation Act:<br>A)Uses the words

Q92: M Corp.has an employee benefit plan for

Q112: What is the effect of the declaration

Q132: The appropriate asset value reported in the

Q136: Distinguish between:<br>(a)Convertible and callable bonds.<br>(b)Serial and term