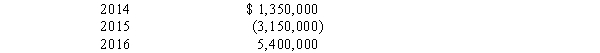

In its first three years of operations Sharp Chairs reported the following operating income (loss) amounts:

There were no deferred income taxes in any year.In 2015,Sharp elected to carry back its operating loss.The enacted income tax rate was 35% in 2014 and 40% thereafter.In its 2016 balance sheet,what amount should Sharp report as current income tax payable?

Definitions:

Economic Advantage

A benefit or edge that allows an entity, such as a business or country, to outperform competitors or achieve superior economic outcomes.

Fracking

A method of extracting oil and natural gas from the earth by injecting high-pressure fluid into subterranean rocks to force open fissures.

Regional Trade Agreements (RTAs)

Treaties between two or more geographically close countries that facilitate trade by reducing tariffs and import quotas, enhancing economic integration.

Q6: With respect to Ralph,what is Oregon's expected

Q7: The attribution approach required by GAAP for

Q36: On January 1,2016,Green Co.recorded a right-of-use asset

Q42: Franklin Freightways experienced ($ in millions)a current:<br>A)Tax

Q56: Nagy Industries reported a net income of

Q66: Which of the following statements characterizes an

Q68: Current liabilities are normally recorded at the

Q107: The pension expense includes periodic changes that

Q125: Costs incurred by the lessor that are

Q195: Mars Inc.has a defined benefit pension plan.On