In LMC's 2018 annual report to shareholders, it disclosed the following information about its income taxes:

INCOME TAXES

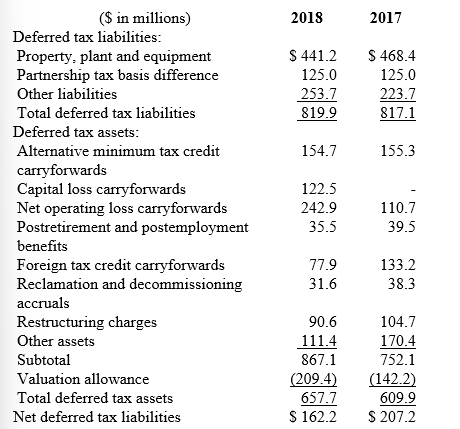

Deferred income taxes reflect the net tax effects of temporary differences between the amounts of assets and liabilities for accounting purposes and the amounts used for income tax purposes.

Significant components of the Company's deferred tax liabilities and assets as of December 31 were as follows:

-Explain why LMC has a $209.4 million valuation allowance for its deferred tax assets.

Definitions:

Licensing Law

Legal regulations governing the process and requirements for granting permissions to individuals or entities to conduct activities that are subject to regulation.

Educational Requirements

Refers to the specific levels of education or particular qualifications necessary for a job position, professional certification, or other formal achievement.

Geographic Restraint

A limitation or restriction on where a person can live or work, often found in employment contracts or legal judgments.

Trade Secrets

Information, including formulas, practices, processes, designs, instruments, patterns, or compilations of information, that is not generally known or reasonably ascertainable, by which a business can obtain an economic advantage over competitors.

Q10: Hart Corporation has an unfunded postretirement health

Q22: Cal Cookie Company (CCC)has 100 million shares

Q27: Rent collected in advance results in deferred

Q37: When more than one security is sold

Q66: On January 1 of the current reporting

Q116: How are deferred tax assets arising from

Q120: What is an antidilutive security?

Q124: The interest expense on an installment note

Q153: What is Hobson's income tax payable for

Q190: DeAngelo Yards,Inc. ,calculated pension expense for its