Cal Cookie Company (CCC)has 100 million shares of $1 par common stock authorized.The transactions below caused changes in CCC's outstanding shares.

January 4,2016: Repurchased and retired 1 million shares at $8 per share.

June 25,2016: Repurchased and retired 2 million shares at $2 per share.

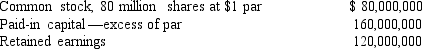

Prior to the transactions,CCC's shareholders' equity included the following:

Required:

Record entries for the above transactions.

Definitions:

Important Values

Fundamental beliefs or standards that guide behaviors and decision-making.

Valuing Process

The act of assessing and recognizing the importance, worth, or usefulness of something or someone in a particular context.

Values Drift

The gradual shift in the core beliefs, principles, and values of an individual or organization over time.

Legal And Ethical

Pertaining to the adherence to both the law and moral guidelines in decision-making processes to ensure fairness, justice, and integrity.

Q2: What should Tringali report as income tax

Q19: During its first year of operations,Criswell Inc.completed

Q25: Under IFRS,a deferred tax asset for stock

Q27: In 2016,Southwestern Corporation completed the treasury stock

Q49: Vrable Corporation has a defined benefit pension

Q51: Explain why Sisters Corporation subtracts equity income

Q59: Franklin's net income ($ in millions)is:<br>A)$134.<br>B)$124.<br>C)$119.4.<br>D)$118.

Q86: On December 31,2016,B Corp.sold a machine to

Q92: Prepare a list of how retiree health

Q140: Listed below are five terms followed by