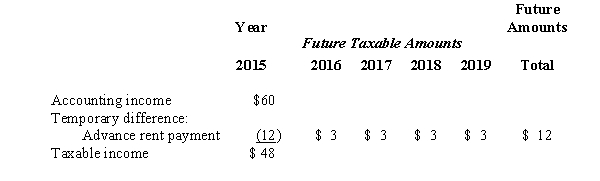

The following information is for James Industries' first year of operations.Amounts are in millions of dollars.

In 2016 the company's pretax accounting income was $67.The enacted tax rate for 2015 and 2016 is 40%,and it is 35% for years after 2016.

Required:

Prepare a journal entry to record the income tax expense for the year 2016.Show well-labeled computations for income tax payable and the change in the deferred tax account.

Definitions:

Environment

The surroundings or conditions in which an organism lives or operates, including natural, social, and cultural factors.

Preformationism

The belief that adultlike capacities, desires, interests, and emotions are present in early childhood.

Ethnography

The study of the cultural organization of behavior.

Plasticity

The brain's ability to change and adapt as a result of experience, often highlighted in discussions of learning and recovery after injury.

Q11: The PBO is increased by:<br>A)An increase in

Q42: Franklin Freightways experienced ($ in millions)a current:<br>A)Tax

Q46: What was General's coupon promotion expense in

Q82: Zwick Company bought 28,000 shares of the

Q82: The cost of promotional offers should be

Q83: A disclosure note in the annual financial

Q88: In this situation,Reagan:<br>A)is the lessee in a

Q104: When cash is received from customers in

Q113: Identify three examples of permanent differences between

Q158: Preferred shares that are participating may:<br>A)Vote for