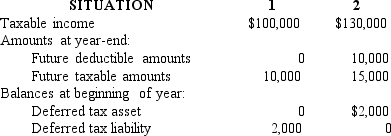

Two independent situations are described below.Each involves future deductible amounts and/or future taxable amounts produced by temporary differences:

The enacted tax rate is 40% for both situations.

Required:

For each situation determine the:

(a. )Income tax payable currently.

(b. )Deferred tax asset - balance at year-end.

(c. )Deferred tax asset change dr or (cr)for the year.

(d. )Deferred tax liability - balance at year-end.

(e. )Deferred tax liability change dr or (cr)for the year.

(f. )Income tax expense for the year.

Definitions:

Social Context

is the immediate physical and social setting in which people live or in which something happens or develops. It includes the culture that the individual is educated or lives in, and the people and institutions with whom they interact.

Amygdala

A part of the brain involved in emotion regulation, emotional learning, and forming memories associated with emotional events.

Nucleus Accumbens

A region in the brain's forebrain that plays a central role in the reward circuit, associated with pleasure, reinforcement learning, and addiction.

Dopamine

Dopamine is a neurotransmitter involved in regulating mood, cognition, reward, and pleasure, among other functions.

Q46: Valuation allowances reduce deferred tax liabilities to

Q55: Listed below are several terms and phrases

Q55: For a capital lease,an amount equal to

Q60: A net operating loss (NOL)carryforward cannot result

Q61: What is the usual effect of a

Q96: Under current tax law,generally a net operating

Q111: On December 31,2015,Rebel Corporation's balance sheet reported

Q126: Which of the terms or phrases listed

Q150: Four independent situations are described below.Each involves

Q181: Eligibility for postretirement health care benefits usually