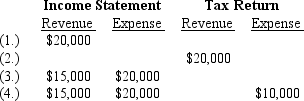

Four independent situations are described below.Each involves future deductible amounts and/or future taxable amounts produced by temporary differences reported first on:

Required:

For each situation,determine the taxable income assuming pretax accounting income is $100,000.Show well-labeled computations.

Definitions:

Informal Process

A method or procedure that is not officially defined or structured, often allowing for flexibility and adaptability.

Resolving Conflict

The process of identifying and addressing differences that could lead to disagreements in a constructive and positive manner.

Face Saving

Actions taken to preserve one's own or another's reputation or dignity in a social context.

Wage Concession

An agreement where workers agree to lower their wages or benefits to help the employer reduce costs, often to avoid layoffs.

Q2: Kline Company refinanced current debt as long-term

Q44: Each of the independent situations below describes

Q68: For the current year ($ in millions),Centipede

Q70: The following information is related to the

Q71: Listed below are five terms followed by

Q81: Large,highly rated firms sometimes sell commercial paper:<br>A)To

Q99: Long-term debt that is callable by the

Q103: When an investor classifies an investment in

Q136: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2444/.jpg" alt=" Tringali's tax rate

Q143: Amortizing prior service cost for pension plans