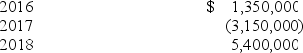

In its first three years of operations Sharp Chairs reported the following operating income (loss) amounts:  There were no deferred income taxes in any year. In 2017, Sharp elected to carry back its operating loss. The enacted income tax rate was 35% in 2016 and 40% thereafter. In its 2018 balance sheet, what amount should Sharp report as current income tax payable?

There were no deferred income taxes in any year. In 2017, Sharp elected to carry back its operating loss. The enacted income tax rate was 35% in 2016 and 40% thereafter. In its 2018 balance sheet, what amount should Sharp report as current income tax payable?

Definitions:

Credit Memo

A document issued to a buyer, crediting them for part of a sale due to a return or overcharge.

Sales Invoice

A document issued by a seller to a buyer, detailing a transaction's products, quantities, and agreed prices for products or services the seller has provided.

Bank Credit Cards

Financial tools issued by banks that allow users to borrow funds for purchases or cash advances, subject to repayment terms and credit limits.

Cash Sales

Transactions where goods or services are exchanged immediately for cash payment.

Q16: Roberto Corporation was organized on January 1,

Q27: Limited liability company<br>A)Similar to an S corporation,

Q83: What should Hobson report as net

Q100: Nickel Inc. bought $100,000 of 3-year, 6%

Q124: A short-term lease:<br>A) Must be accounted for

Q139: By the lessee, a lessee-guaranteed residual value

Q141: The following information relates to Schmidt

Q142: On January 1, 2018, NaviFast leased telecommunications

Q146: On September 15, 2018, the Scottie Company

Q146: What was the actuary's interest (discount)