In LMC's 2018 annual report to shareholders, it disclosed the following information about its income taxes:

INCOME TAXES

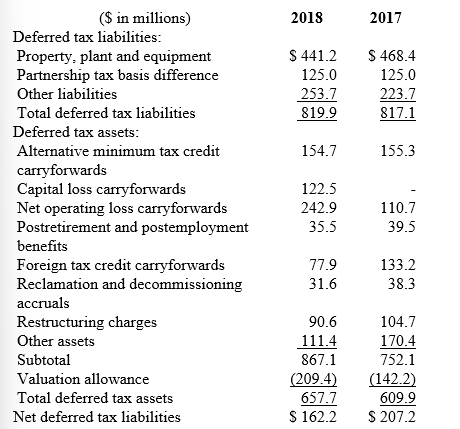

Deferred income taxes reflect the net tax effects of temporary differences between the amounts of assets and liabilities for accounting purposes and the amounts used for income tax purposes.

Significant components of the Company's deferred tax liabilities and assets as of December 31 were as follows:

-Indicate why LMC lists net operating loss carryforwards as a component of deferred tax assets.

Definitions:

Similar Products

Items or services that share common features, functions, or characteristics with others, often within the same category.

Demand Factors

Variables that influence the desire and ability of consumers to purchase goods and services, such as price, income levels, and preferences.

Similar Products

Products that fulfill the same needs or wants and are therefore seen as alternatives or competitors to each other.

Consumer Tastes

Preferences or inclinations of consumers that influence their purchasing behavior, often shaped by cultural, social, and personal factors.

Q64: Interperiod tax allocation<br>A)Is usually a revenue or

Q79: Several years ago, Western Electric Corp. purchased

Q100: Beasley Crossing prepares its financial statements in

Q114: On June 30, 2018, K Co. had

Q120: Pension data for Matta Corporation include

Q135: The costs that (a) are associated directly

Q146: <br>What should Kent report as the current

Q156: ZIP Company owns 40,000 shares of the

Q187: Dharma Initiative, Inc, has a defined benefit

Q216: Defined contribution pension plans that link the