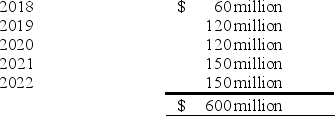

Isaac Inc. began operations in January 2018. For certain of its property sales, Isaac recognizes income in the period of sale for financial reporting purposes. However, for income tax purposes, Isaac recognizes income when it collects cash from the buyer's installment payments. In 2018, Isaac had $600 million in sales of this type. Scheduled collections for these sales are as follows:  Assume that Isaac has a 30% income tax rate and that there were no other differences in income for financial statement and tax purposes.

Assume that Isaac has a 30% income tax rate and that there were no other differences in income for financial statement and tax purposes.

-

Ignoring operating expenses, what deferred tax liability would Isaac report in its year-end 2018 balance sheet?

Definitions:

Mexican Government

The federal republic governing structure of Mexico, comprised of executive, legislative, and judicial branches.

Fixed Exchange-rate System

A currency system where the value of a country's currency is pegged to the value of another currency, a basket of other currencies, or another measure of value such as gold.

Demand for Dollars

Refers to the global desire or need for U.S. currency, driven by its use in international trade, investment, and as a reserve currency.

Q38: In a finance lease, the amortization of

Q50: On January 1, 2018, Duncan-Lang Services, Inc.

Q79: Fisher Company leased equipment from Orkney Industries.

Q80: Four independent situations are described below. Each

Q96: Discuss the financial statement disclosure requirements for

Q107: The projected benefit obligation:<br>A) contains periodic service

Q116: On January 1, 2018, Marlon's Transport leased

Q158: Each of the independent situations below

Q171: Bonds usually sell at their:<br>A) Maturity value.<br>B)

Q179: Heidi Aurora Imports applies International Financial Reporting